Authored by: Punit Khandelwal & Sunit Khandelwal

Foreword

Finance Bill, 2017 had introduced new section 50CA and a new clause (x) in sub-section (2) of section 56 to bring into tax ambit situations where consideration for transfer is less than fair market value (FMV) or where money/property is received without/inadequate consideration. One of the more common situations where this section and clause triggers is with respect to unquoted shares.

While CBDT has notified Rule 11UA providing the rules for valuation of unquoted equity shares, we realise that questions that pass through while working on a rule-based valuation are intertwined with accounting, tax interpretations, economic and control features embedded in the shares among other on-ground issues.

In this paper, we have attempted to analyse special situations to the extent possible while dealing with rule 11UA(1)(c)(b) (the “Rule”) of the IT Rules. Considering that there can be several real-life scenarios where an explicit treatment is not provided in the Rule for a specific balance sheet asset or liability and the valuer may have to take a view based on his/her understanding of the background of the case, we have come up with this paper identifying valuation challenges of the said Rule and our views on few situations where there is no clear explanation provided currently. We are hoping that you find the findings insightful.

….. Extract of Finance Bill, 2017

Fair Market Value to be full value of consideration in certain cases

- “Under the existing provisions of the Act, income chargeable under the head "Capital gains" is computed by taking into account the amount of full value of consideration received or accrued on transfer of a capital asset. In order to ensure that the full value of consideration is not understated, the Act also contained provisions for deeming of full value of consideration in certain cases such as deeming of stamp duty value as full value of consideration for transfer of immovable property in certain cases.

- In order to rationalise the provisions relating to deeming of full value of consideration for computation of income under the head "capital gains", it is proposed to insert a new section 50CA to provide that where consideration for transfer of share of a company (other than quoted share) is less than the Fair Market Value (FMV) of such share determined in accordance with the prescribed manner, the FMV shall be deemed to be the full value of consideration for the purposes of computing income under the head "Capital gains".

- This amendment will take effect from 1st April, 2018 and will, accordingly, apply in relation to the assessment year 2018-19 and subsequent assessment years.”

Widening scope of Income from other sources

- “Under the existing provisions of section 56(2)(vii), any sum of money or any property which is received without consideration or for inadequate consideration (in excess of the specified limit of Rs. 50,000) by an individual or Hindu undivided family is chargeable to income-tax in the hands of the resident under the head "Income from other sources" subject to certain exceptions. Further, receipt of certain shares by a firm or a company in which the public are not substantially interested is also chargeable to income-tax in case such receipt is in excess of Rs. 50,000 and is received without consideration or for inadequate consideration.

- The existing definition of property for the purpose of this section includes immovable property, jewellery, shares, paintings, etc. These anti-abuse provisions are currently applicable only in case of individual or HUF and firm or company in certain cases. Therefore, receipt of sum of money or property without consideration or for inadequate consideration does not attract these anti-abuse provisions in cases of other assessees.

- In order to prevent the practice of receiving the sum of money or the property without consideration or for inadequate consideration, it is proposed to insert a new clause (x) in sub-section (2) of section 56 so as to provide that receipt of the sum of money or the property by any person without consideration or for inadequate consideration in excess of Rs. 50,000 shall be chargeable to tax in the hands of the recipient under the head "Income from other sources". It is also proposed to widen the scope of existing exceptions by including the receipt by certain trusts or institutions and receipt by way of certain transfers not regarded as transfer under section 47.

- Consequential amendment is also proposed in section 49 for determination of cost of acquisition.

These amendments will take effect from 1st April 2017 and the said receipt of sum of money or property on or after 1st April 2017 shall be chargeable to tax in accordance with the provisions of proposed clause (x) of sub-section (2) of section 56.”

What the rule says

- When any person in the Indian jurisdiction, transfers unquoted equity shares, there are two sections of the IT Act, which are required to be considered and complied with:

- S. 50CA concerning capital gain tax – to assess whether the consideration received by the transferor as part of the proposed transaction by the company is less than the fair market value (FMV) as computed under rule 11UA.

- S. 56(2)(X) relating to other income – where the transferee will be required to pass the test of consideration paid in the transaction which if it is less than the FMV then the difference shall be chargeable as Other Income.

- For the purpose of valuation computation under either of the above sections, IT Act has prescribed that valuation has to be done as per rule 11UA(1)(c)(b) of the IT Act

- The Rule provides for valuation of unquoted equity shares, as per the following formula:

Fair market value (“FMV”) of unquoted equity shares = (A+B+C+D-L) x PV/PE, where

A - Book value of all the assets (except those mentioned at B, C and D below) as reduced by income tax paid as advance tax/TDS/TDC (net of refund) and any amount shown in the balance sheet as asset including the unamortized amount of deferred expenditure which does not represent the value of any asset

B - Fair market value of jewellery and artistic work based on the valuation report of a registered valuer

C - Fair market value of shares or securities as determined according to this rule

D - Stamp duty valuation in respect of any immovable property

L - Book value of liabilities, excluding:

- the paid-up capital in respect of equity shares;

- the amount set apart for payment of dividends on preference shares and equity shares where such dividends have not been declared before the date of transfer at a general body meeting of the company;

- reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart towards depreciation;

- any amount representing provision for taxation, other than the amount of income-tax paid, if any, less the amount of income-tax claimed as refund, if any, to the extent of the excess over the tax payable with reference to the book profits in accordance with the law applicable thereto;

- any amount representing provisions made for meeting liabilities, other than ascertained liabilities;

- any amount representing contingent liabilities other than arrears of dividends payable in respect of cumulative preference shares;

PV - Paid-up value of equity shares

PE - Total amount of paid-up equity share capital as shown in the balance sheet.

- In the practical world, valuers may encounter various challenges around the implementation of the above Rule ranging from:

- Inclusion or exclusion of assets and liabilities which have not been explicitly defined, or

- Situations which require clarification from Central Board of Direct Taxes (“CBDT”) and until then we have provided our view on the valuation treatment

- In the section below, we have highlighted few such situations and our view on the treatment for the purpose of the valuation under the Rule. This is not an exhaustive list and there can be more such situations.

Valuation Challenges & Our View

We have categorised the valuation challenges of the Rule under following broad areas which are not exhaustive but illustrative based on our practical experience and understanding:

1. Complex equity instruments with embedded rights and options

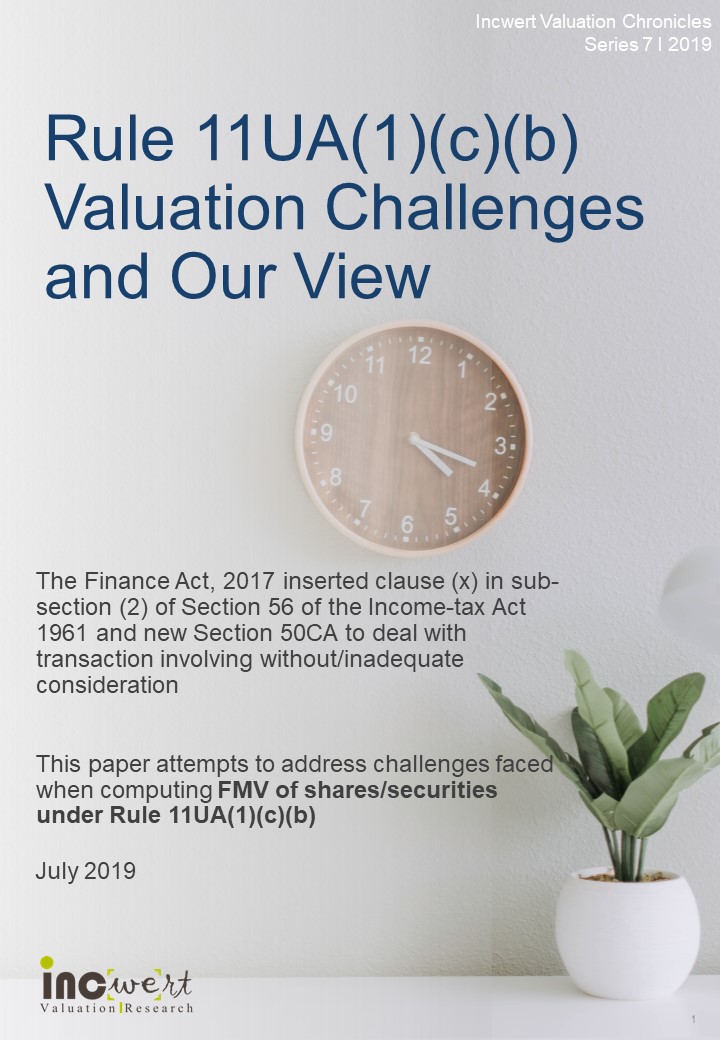

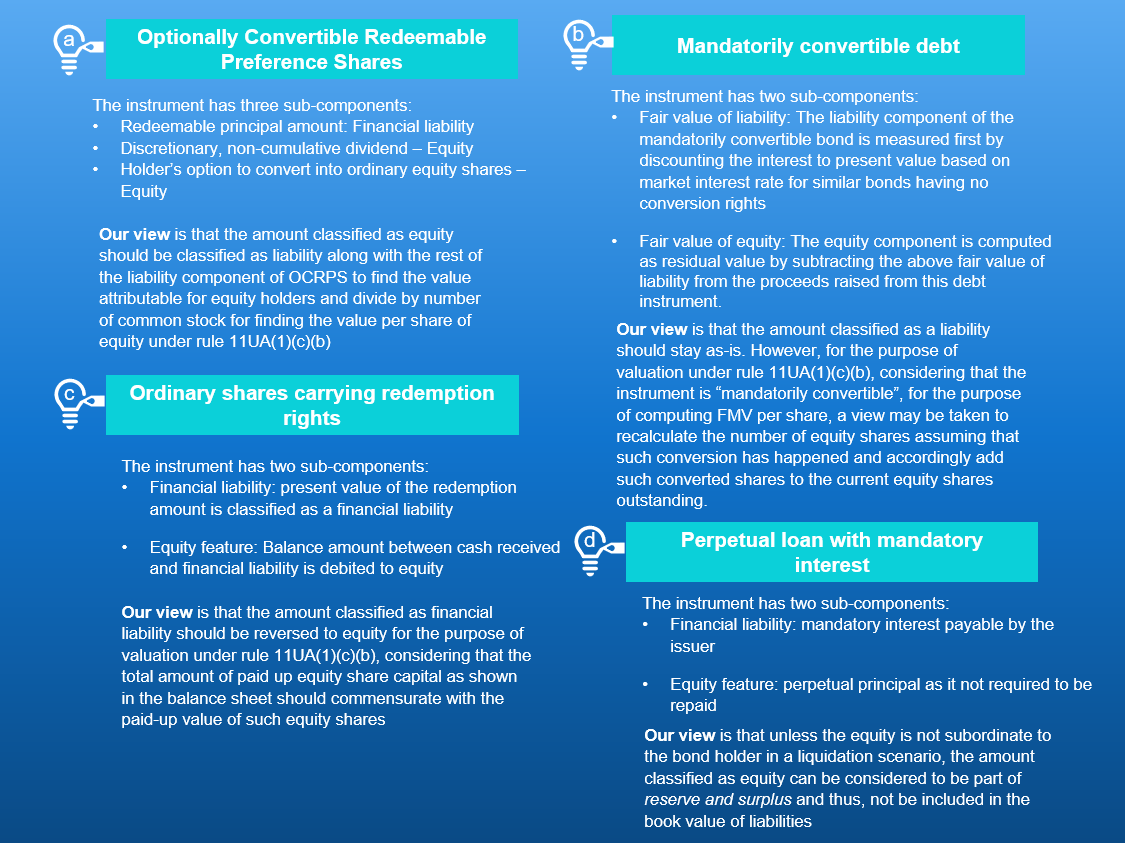

Complex capital instruments having differential shareholder rights governed by shareholder agreements have become increasingly common in start-ups and other companies which have raised money from private equity sponsors. For example, in instruments which are convertible into fixed number of equity shares like optionally convertible redeemable preference shares (“OCRPS”) with discretionary non-cumulative dividend and mandatorily convertible debt, a certain portion is accounted as a liability and the rest is classified as equity as per Ind AS 32 and Ind AS 109 on classification, recognition and measurement of financial instruments.

We believe that the classification done for the purpose of Ind AS should not be taken on as-is basis for the purpose of passing the test of liability under rule 11UA(1)(c)(b) because we are doing the valuation exercise using NAV method and attributing value to equity shareholders which can be rightfully mapped to them. There cannot be one blanket rule and such evaluation will require detailed analysis of the rights and then make appropriate adjustments.

Let’s continue with few illustrative instruments to evaluate on how they should be looked upon for the purpose of the valuation Rule:

2. Interest-free loan from group company

As per Ind AS 32 and Ind AS 109, the interest-free loan is measured at fair value computed by discounting the loan amount by the market interest rate for similar loans. Such fair value of the loan is recognised as liability and remainder is classified as other equity. Over a period, the loan liability is constantly increased through a charge in the profit and loss account.

Our view: We are of the opinion that the portion being shown under other equity should be reclassified as liability for the purpose of calculating NAV under the Rule. There is structural subordination of equity in a liquidation scenario, and hence, equity holders will not have claim over such loan amount classified as the other equity.

3. Leases

As per recently notified Ind AS 116, operating leases are required to be accounted on balance sheet by recognising a liability and a corresponding asset. Operating lease liability is required to be computed as the present value of the remaining lease payments, discounted using the lessee’s incremental borrowing rate. An asset is recognised as right-of-use and is depreciated over the useful life of this asset.

Our view: Asset-side right-of-use is an intangible asset, and hence it is not an immovable property for the purpose of rule 11UA. W.r.t the lease liability, we are of the view that the same should be treated as a liability for the purpose of the Rule. Hence, operating leases should be accounted for by taking the book value of the leased asset and liability as reported on the balance sheet

Tax-interpretation Based Challenges

1. Minimum alternate tax (MAT) credit entitlement

MAT credit entitlement is appearing as an asset on the balance sheet, then?

Our View is that it should be considered as an asset for the purpose of the above valuation Rule because it represents the value of the underlying asset and will be available for offsetting future tax liability

2. Provisions made for employee benefits like compensatory leaves and gratuity

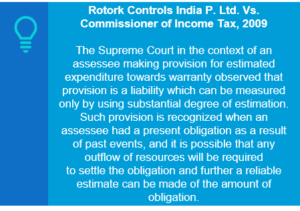

The Rule states that “any amount representing provisions made for meeting liabilities, other than ascertained liabilities” should not be considered as part of liabilities. A question arises: whether provision made for employee benefits like compensatory leaves and gratuity is ascertained or not ascertained?

Our View: Sine such provisions are made based on some scientific approach by analysing past data, these provisions can be considered as ascertained liabilities.

Similarly, in the case of product warranties, it is ascertained liability and not a contingent liability.

3. Income taxes paid in dispute

The Rule states that “any amount of income-tax paid, if any, less the amount of income-tax refund claimed if any” should be reduced from the total assets as calculated as per the Rule.

Our View is that income taxes paid in dispute should not be considered as an asset and accordingly reduced from the overall assets. An exception can be where the Company has claimed such income tax paid in protest as a refund in their income tax return which can be validated by analysing the company’s ITR-6.

4. Definition of book profits for the purpose of the above Rule

One of the adjustments in the liability computation for the above Rule is that any excess provision made for income tax in comparison to taxes payable w.r.t book profits should be reversed and hence reduce the liability by that excess amount. The Rule is silent on the definition of “book profits” as well as the income tax rate which should be used for computing taxes.

Our view is that the reference is to book profits as computed for the purpose of section 115JB of the IT Act and the income tax rate may be taken by referring to the marginal tax rate for the company.

5. Deferred tax assets/ liabilities (DTA/DTL)

The Rule states, “any amount shown as asset …which does not represent the value of any asset” should be excluded from the assets computed for the purpose of this Rule.

Our view is that DTA is such an asset on balance sheet which does not represent the value of any asset and hence should be excluded from the assets.

On Ground Challenges

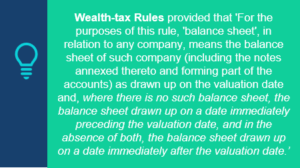

1. Valuation date

Rule 11U of the IT Act states that for the purpose of valuation under rule 11UA, the date of valuation must be the date on which the asset is transferred. However, in real life, a valuer can encounter situations where the balance sheet is not available as of the date of the transfer of assets.

Our View: CBDT perhaps considered the point that valuation accretion or destruction for start-ups happens at a highly accelerated pace with significant value movement at each round of successful fund raise. However, satisfying the requirement of transaction date balance sheet in most situations will be impractical and hence, a cue can be taken from the wealth tax rules.

The valuer may choose to do the valuation as of the latest balance sheet available and take a management representation that no material change has happened in the value of assets and liabilities between the balance sheet date and the valuation date.

2. Audited financials

Rule 11U of the ITA states that for the purpose of valuation under rule 11UA, the balance sheet used for the FMV computation should be audited. However, in real life, a valuer can come across situations where the financials are still not audited. What should be the recourse?

Our View: Valuer should seek audited financials from the management of the company and if the management of the company is not able to provide then seek explanation and take a management representation that they do not expect any material change in the value of assets and liabilities between the provisional financials and the audited financials which would be available at a future date.

3. Investment in foreign subsidiaries

The Rule states that “fair market value of shares or securities as determined according to this rule” shall be considered. Hence, for any investment in subsidiaries, the value of such investments will be computed by doing the same FMV exercise under the Rule by using the balance sheet of the subsidiary. However, how should the valuation of such shares be done if such investment is in a foreign subsidiary?

Our view: Since such subsidiaries are governed by the jurisdiction of the laws of the land where such subsidiary is incorporated, hence the India tax law and stamp duty law may not be applicable to them and accordingly, one option could be to take the net asset value of such investments as fair value and provide the explanation in the report and reason for such assumption.

Other Issues

1. Differential Voting Rights in equity shares

Shares with differential voting rights (DVRs) simply means that a company has issued more than one class of stocks with different voting rights. A question arises whether the value assigned at the equity level reflects the FMV of the share with differential voting rights.

Our View: DVRs provide an ability to influence or control the enterprise in a manner that is disproportionate to the percentage holdings.

The Rule in its present casing does not address this loophole which gets compounded by the fact that despite such rights being substantive and meaningful, their value is not objectively and readily measurable. CBDT will need to suitably amend the Rule to ensure that the provision of 50CA and 56(2)(x) are not bypassed through the mechanism of DVRs

2. Share application money pending allotment

The Rule requires reserves and surplus, by whatever name called, even if the resulting figure is negative, other than those set apart

towards depreciation to be not included in the liabilities. Under Ind AS regime, share application money pending allotment is presented as part of “other equity” and as such, for the purpose of this Rule may require adjustment

Our View: Other equity component in the balance sheet should be carefully analysed to ensure that items other than Reserve and Surplus are correctly identified and adjusted in determining the liabilities.

3. Treasury shares/ ESOP reserves

Companies which have treasury shares or ESOP reserves, what should be the treatment?

Our View: The nature of treatment would be similar to the share application money pending allotment. ESOP reserves are the funds earmarked for the employees and thus while determining the value under the Rule, it should be adjusted as a liability of the enterprise.

Closing Thoughts

Rule 11UA(1)(c)(b) valuation requires the valuer to do the valuation as per the formula and hence does not give the flexibility to take any other approach except what is provided in the rule.

However, we have noticed that there are several situations where the Rule does not provide an explicit language to either include or exclude a specific balance sheet item. Further, in such cases, where neither a judicial precedent nor a clarification from CBDT is available, we have expressed our views based on our understanding.

Our views are broadly based on substance over form and we have applied financial logic to why an adjustment is either required or not required a specific asset or liability for the purpose of FMV calculation under the said Rule.

Disclaimer:

This publication has been carefully prepared only for education purpose and is not a research report or any kind of investment advice. Neither authors of this publication nor Incwert Advisory Private Limited have any kind of conflict of interest with any company / firm / entity which have been cited and have been used for the sole purpose of illustration. It has been written in general terms and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. It should be seen as broad guidance only and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice after a thorough examination of the particular situation. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this proposal, and, to the extent permitted by law, Incwert Advisory Private Limited (“Incwert”), its members, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. Without prior permission of Incwert, this publication may not be quoted in whole or in part or otherwise referred to in any documents.