Foreword

“Growth is not inevitable and firms may not remain as going concerns. In fact, even large publicly traded firms sometimes become distressed for one reason or the other and the consequences for value can be serious.” – Aswath Damodaran, The Cost of Distress: Survival, Truncation Risk and Valuation, January 2006.

But what if the firm could stay afloat post-default and hence shouldn't the system peddle for more resolutions versus liquidations? And, shouldn’t such resolutions be time-bound? Answer to all these questions is an obvious “yes”.

However, we note that a mere 20% of total cases resulted in resolution plans and the rest 80% closed through liquidation. We believe that the percentage of resolution cases should meaningfully increase because in most cases going concern value is usually higher than net asset value.

Further, in more than 33% of total ongoing Corporate Insolvency Resolution Process (CIRP), the proceedings are more than 270 days old (deadline for closure) from the date of admission. Considering large delays happening in every one out of three cases, the authority recently passed a bill to increase the deadline to 330 days, providing an additional 60 days for litigations.

The progress and agility of IBC has been good versus older restructuring regimes in India where the average time taken was around 4 years, but more work must be done on the ground to create path for more resolution plans and less of liquidations plus faster timeframe to ensure value is not meaningfully eroded for the underlying asset

Background

- The Insolvency and Bankruptcy Code, 2016 was introduced to create a time-bound resolution process for defaulted loans and bonds in India. A year later, in May 2017, the Reserve Bank of India (RBI) was vested with legislative powers to initiate proceedings to recover bad loans for effective use of IBC.

- We believe that success of IBC will help in several ways like i) building the foundation for a healthy credit market in India, ii) eventually create liquidity for debt instruments (though this could be a long haul) and iii) improve the attractiveness for global investors to invest in the Indian debt market. Resolving Insolvency is one of the parameters of the World Bank ranking of ‘Ease of Doing Business’. India’s ranking was at 137th position in 2015 (across 190 countries), and since then it has substantially improved to 77th rank as of 2018.

- The Code provides an overall timeline of 330 days (recently increased from 270days) to conclude a corporate insolvency resolution process, including time spent on litigation, in contrast with the previous regime where processes took about 4.3 years (1).

- Considering the importance of progress updates on IBC, we will come up with periodic publication every quarter to provide updates on the defaults, claim admissions and recoveries under the name “IBBI Quarterly Flash” which will be a part of our overall Incwert Valuation Chronicles monthly publications.

- This is our second publication in the periodic series of IBBI Quarterly Flash. Our previous series can be downloaded from https://incwert.com/publications/

Insolvency – trends and our views

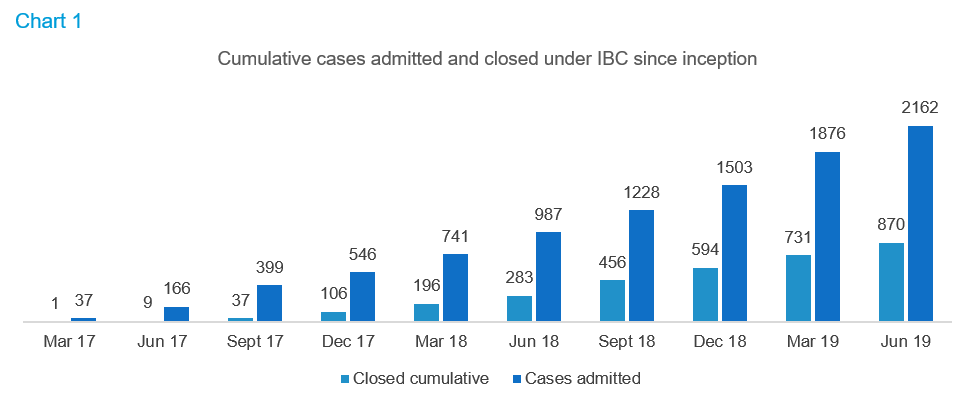

- Since its inception, a total of 2,162 cases have been admitted under IBC.

- Closure of cases under IBC, could be either through Appeal/Review/Settlement, Withdrawal under section 12A, Approval of resolution plan or through the commencement of liquidation. Out of total admissions around 870 cases (representing 40%) of the cases have been closed till now. (Refer to Chart 1)

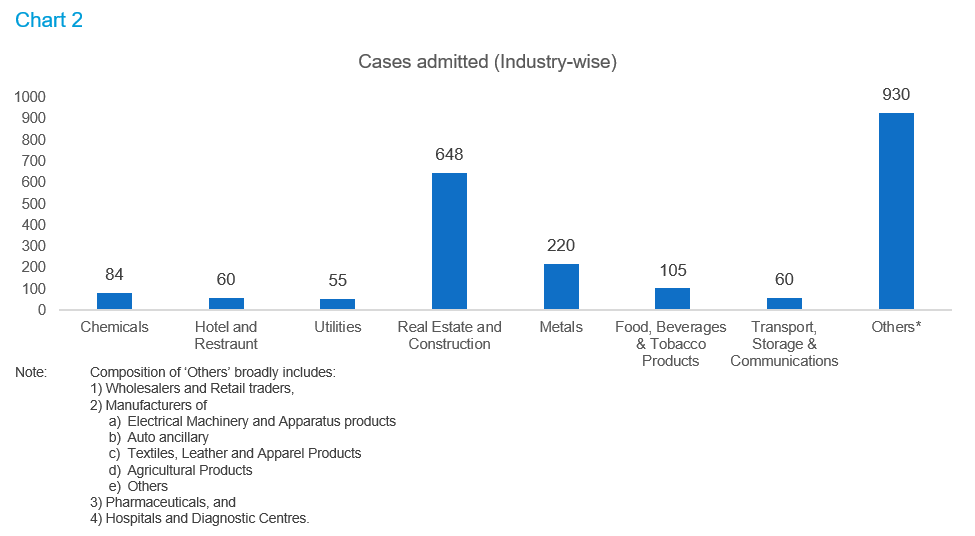

- Real Estate and Construction has been a sector where highest number of Insolvency is admitted. (Refer to Chart 2)

- Further, out of total admissions, in 120 cases (i.e. 6% of cases admitted and 14% of cases closed), resolution plan has already been approved.

Recoveries – trends and our views

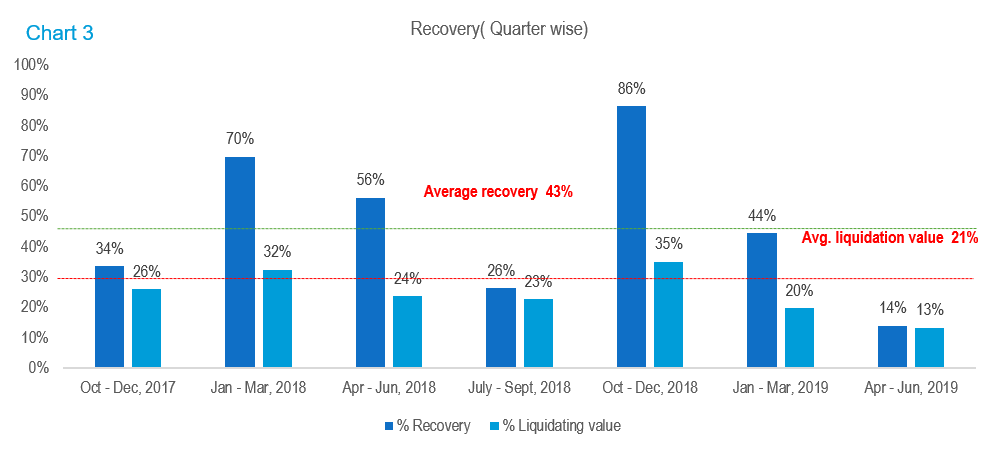

- 43% average recoveries over the last 2 years with 14% in the most recent quarter. A sharp decline in recoveries versus last quarter was driven by a dip in IBC cases in the metal and other industries where it reduced to 36% in the current quarter (2QCY19) versus 78% in 1QCY2019.

- Recoveries are almost 2x the liquidation value, with lowest in Apr-June 2019 quarter (1.1x) and highest in Oct-Dec 2018 quarter (2.5x). (Refer to Chart 3)

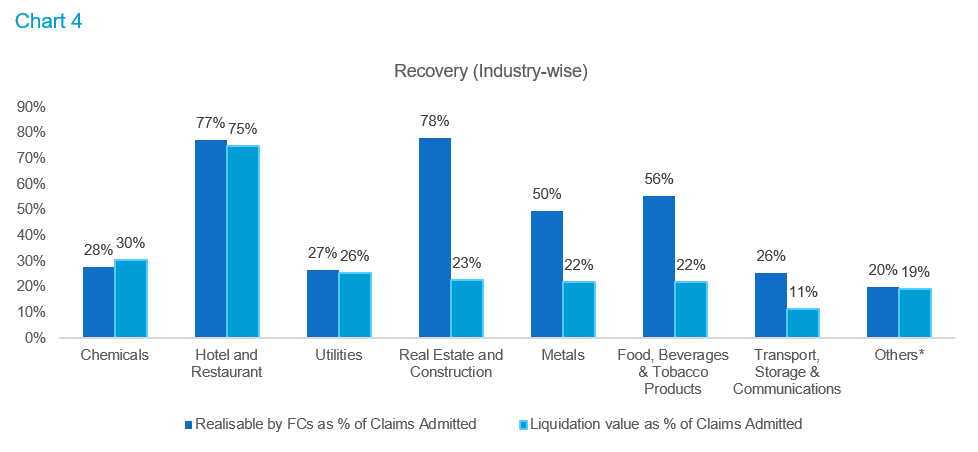

- Recoveries in the Real Estate and Construction sector is highest, followed by the Hotel Industry and Food and Beverage industry. But if we further dig onto the data, we could find that resolution plans yielded (as a multiple of liquidation value) lowest in the Chemicals sector (0.93x) in comparison to other sectors. (Refer to Chart 4)

Analysis by initiators

- Under Insolvency Bankruptcy Code (IBC), insolvency can be initiated by either financial creditors (FC) or operational creditors (OC) or corporate debtor (CD).

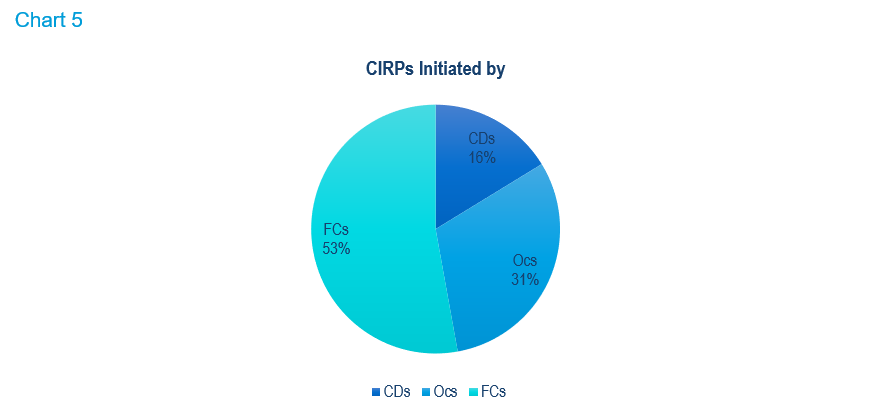

- CIRP initiated majorly by FCs (53%) followed by OCs (31%) and remainder by CDs (16%) (Refer Chart 5)

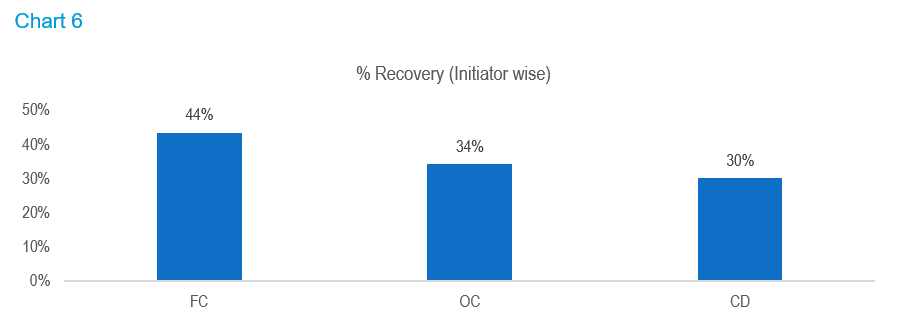

- Recoveries were highest in CIRPs initiated by FCs at 44% followed by situations in which OCs initiated (34% recovery) and lowest at 30% recovery when CDs themselves filed for insolvency. (Refer to Chart 6)

Twelve Large Accounts

- In the year 2015, the Indian Government introduced IBC, a tailor-made code for the resolution of bad loans in the winter session of the Parliament. The code was passed by Lok Sabha and got President’s nod in May 2016. A year later, in May 2017, the RBI was vested with legislative powers to initiate proceedings to recover bad loans for effective use of IBC.

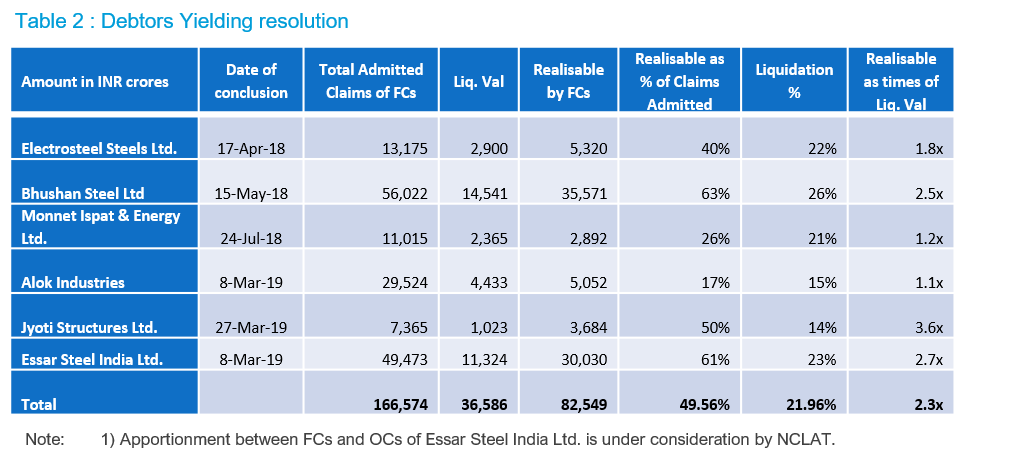

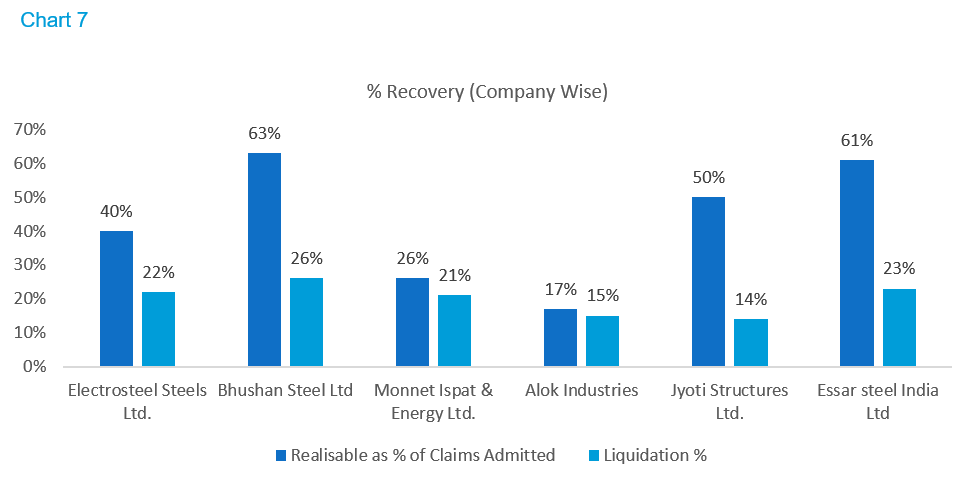

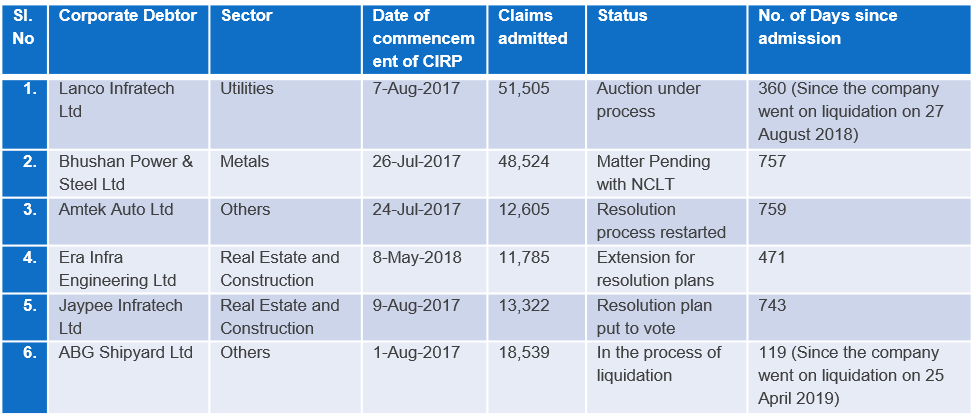

- Thereafter, on 13 June 17, RBI released a list of 12 companies constituting 25% of India’s total NPAs (Non-Performing Assets) under the name ‘Dirty Dozen’. Together they had an outstanding claim of Rs 3.45 lakh crore as against their liquidation value of Rs 73,220.23 crore

- These 12 shortlisted companies under the IBC that have fund/non-fund exposure of above Rs 5,000 crore where 60 per cent or more has turned bad.

Resolution yielded

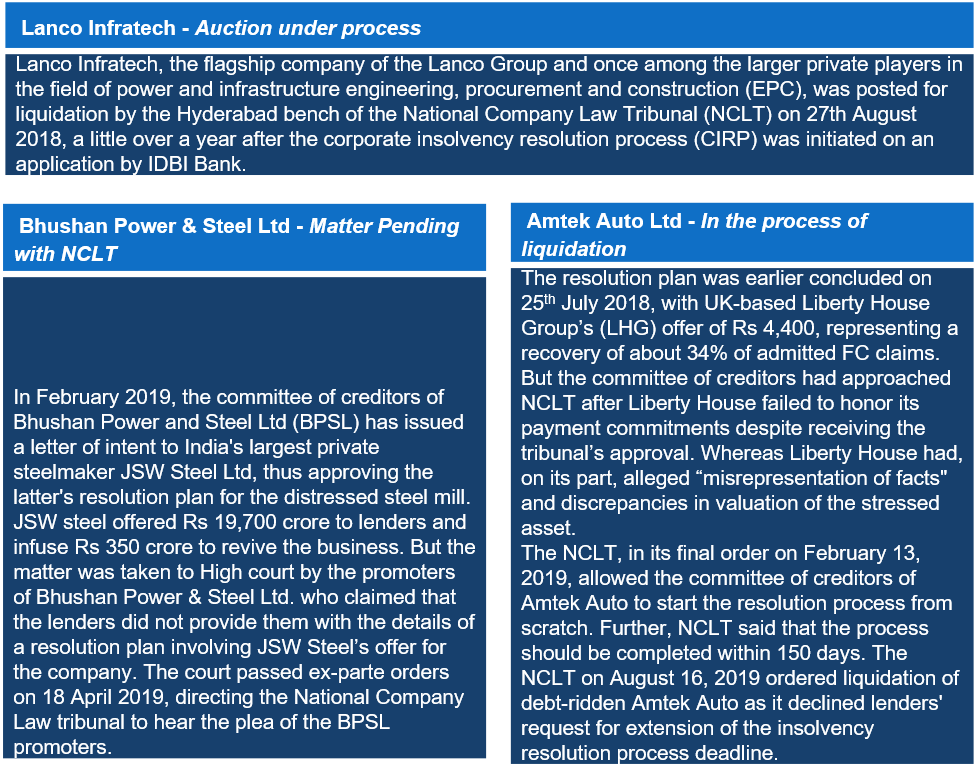

- As on 30th June 2019, of these 12 accounts resolution process, six Corporate Debtors have been approved. Due to failure of implementation of the approved resolution plan in Amtek Auto Limited, the process has restarted. Other accounts are at different stages of the process.

- The below six corporate debtors represent 76% of total claims realised under IBC and 66% of total claims admitted under Corporate Insolvency Process.

- Recovery percentage for the six accounts was approximately 50%, in comparison to liquidation percentage of 23 %.

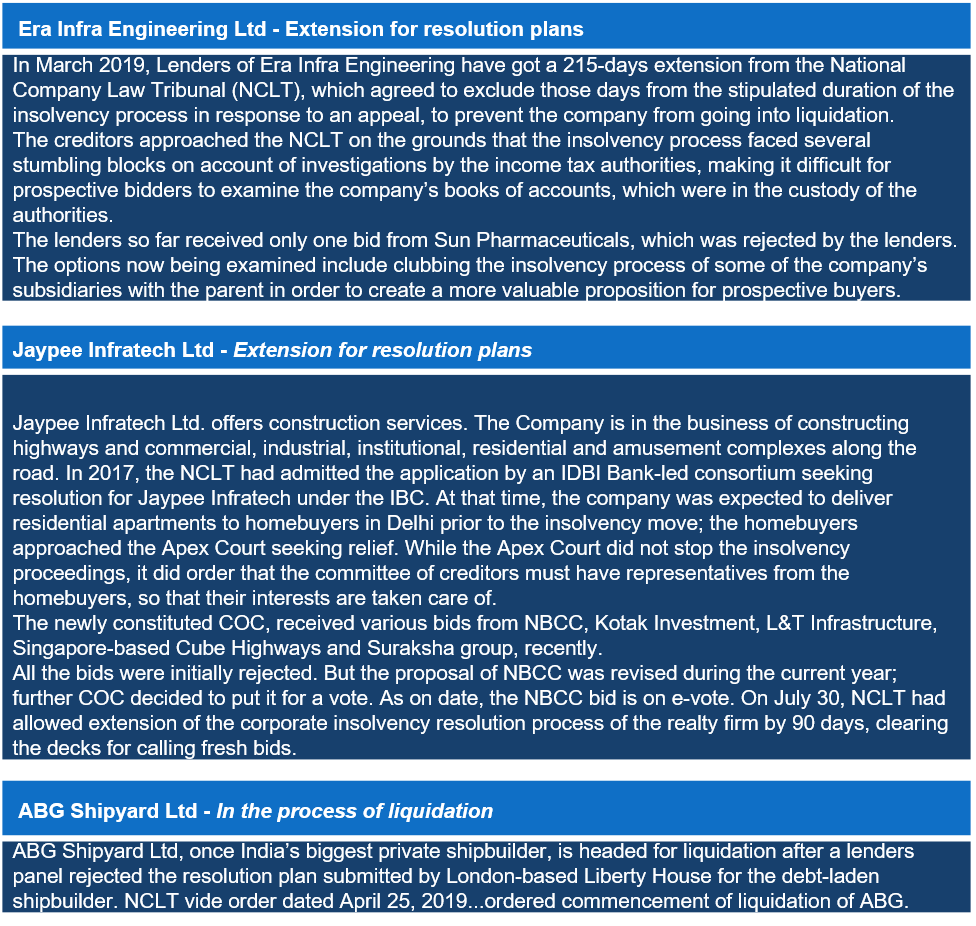

Debtors in process

Conclusion

We believe that though there have been significant delays in resolutions with 6 of the 12 large accounts still in progress, we need to appreciate that the development has been significantly better than earlier resolution regimes in India.

We see the below areas of improvement:

- Quicker time-bound resolutions

- More resolutions versus liquidations

Respect risk-reward principle and accordingly create waterfall payoffs for secured creditors ahead of unsecured creditors. Do not mix emotional quotient with economics – someone who is unsecured was already rewarded through higher yields and hence should be ready to take the risk of loss given default