Authored by: CA Punit Khandelwal, CA Sunit Khandelwal and Prof. Divya Aggarwal (EMLV, France; ex-professor at IIM, Ranchi, India)

Foreword

We are pleased to issue the 6th edition of the India Equity Risk Premium (2024) study, which analyses the risk premium to be considered when determining the cost of equity using the capital asset pricing model.

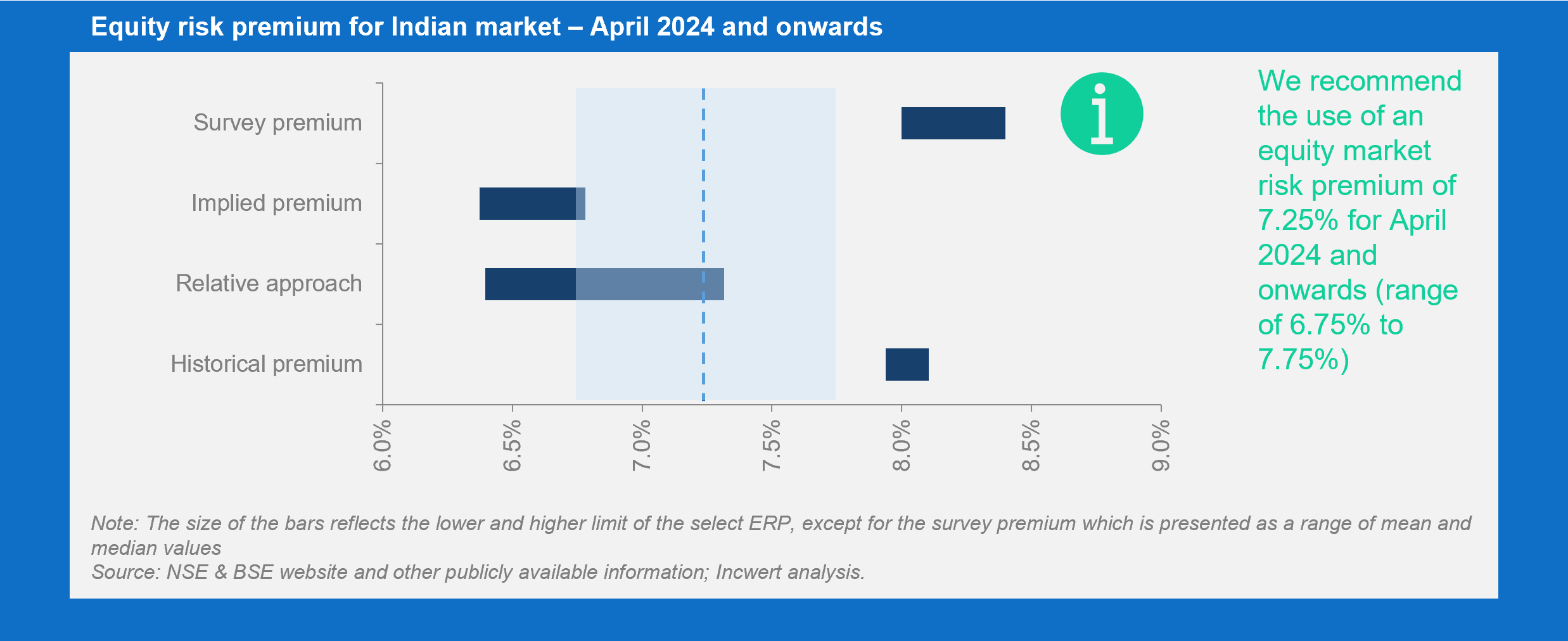

The study focuses on quantitative analysis to derive the current equity risk premium under different approaches including a) historical premium, b) survey approach, c) country bond default spread approach, d) country bond default spread approach adjusted for relative country risk, e) domestic market volatility relative to a developed market and f) implied equity risk premium.

We observe that the historical ERP is higher than the implied ERP possibly because investors are cautious despite favourable market conditions due to concerns about overvaluation, economic uncertainty, national elections and other global factors including persistent high interest rate in the US, Israel-Iran conflict and inflation among others.

Accordingly, based on the current market conditions, we recommend India ERP of 7.25% (6.75% and 7.75% being the lower and upper limit of the range, respectively) beginning in April 2024.

We hope you find the results of our study of interest and value.