Authored by: Punit Khandelwal & Sunit Khandelwal

Assisted by: Ajay Aggarwal

Foreword

“Measured by post-default trading prices, the issuer-weighted average recovery rate for senior unsecured bonds (across the globe) was 53.9% in 2017, up sharply from 31.5% in 2016, reflecting higher recoveries in distressed exchanges and improved recoveries in commodity sectors” – Moody’s report, Annual Default Study: Corporate Default and Recovery Rates, 1920 – 2017, dated February 2018.

The agency also noted that the long-term recovery average for senior unsecured bonds across the globe (with a majority, 90%+, of the rated issuers being in the US & Europe) was circa 38%.

Against this background, we note that the average recoveries of c.43% for financial creditors on cases which yielded resolution under Corporate Insolvency Resolution Process (CIRP) with Insolvency and Bankruptcy Board of India (IBBI), since the inception in December 2016 until March 2019 is a good start and bodes well for the future of debt market in India. The regulatory body also mentioned that the recovery values via the resolution process were approximately 1.9x more than the liquidation values computed for such companies.

In this quarterly publication, we aim to present the insights on defaults and recoveries. Further, we have discussed the status of each of the 12 Big Accounts under the Insolvency Bankruptcy Code (IBC).

Background

- The Insolvency and Bankruptcy Code, 2016 was introduced to create a time-bound resolution process for defaulted loans and bonds in India. A year later, in May 2017, the Reserve Bank of India (RBI) was vested with legislative powers to initiate proceedings to recover bad loans for effective use of IBC.

- We believe that success of IBC will help in several ways like i) building the foundation for a healthy credit market in India, ii) eventually create liquidity for debt instruments (though this could be a long haul) and iii) improve the attractiveness for global investors to invest in the Indian debt market. Resolving Insolvency is one of the parameters of the World Bank ranking of ‘Ease of Doing Business’. India’s ranking was at 137th position in 2015 (across 190 countries), and since then it has substantially improved to 77th rank as of 2018.

- The Code provides a timeline of 180 days to conclude a corporate insolvency resolution process, extendable by a one-time extension up to 90 days. This push has meant that proceedings under the Code can take on average about 300 days, including time spent on litigation, in contrast with the previous regime where processes took about 4.3 years (1).

- Considering the importance of progress updates on IBC, we will come up with periodic publication every quarter to provide updates on the defaults, claim admissions and recoveries under the name “IBBI Quarterly Flash” which will be a part of our overall Incwert Valuation Chronicles monthly publications.

- This is our first publication in the periodic series of IBBI Quarterly Flash.

Insolvency – trends and our views

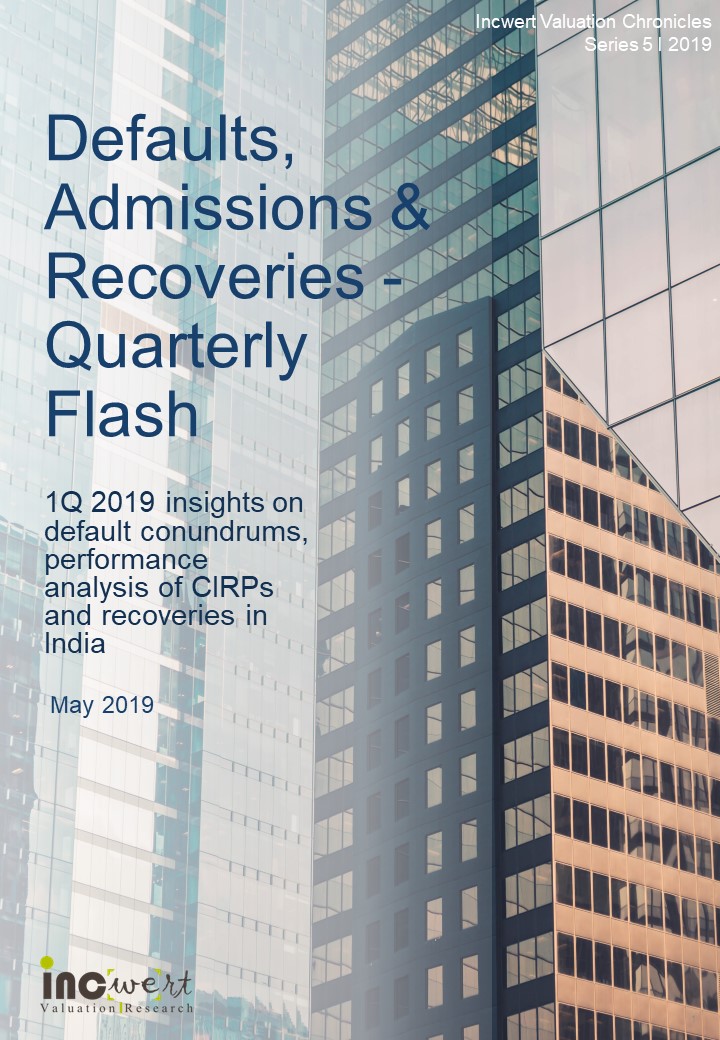

- Since its inception, a total of 1,858 cases have been admitted under IBC.

- Out of total admissions around 715 cases (representing 38%) of the cases have been closed till now. Closure of cases under IBC could be either through appeal/review/settlement, withdrawal under section 12A, approval of resolution plan or through the commencement of liquidation.

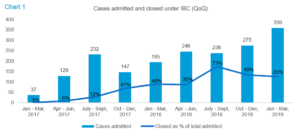

- Real Estate and Construction has been a sector where the highest number of insolvency cases were admitted. (Refer to Chart 2)

- Further, out of total admissions, in 94 cases (i.e. 5% of cases admitted and 13% of cases closed), resolution plan has already been approved.

Recoveries – trends and our views

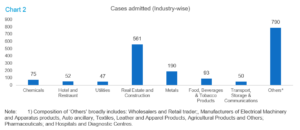

- 43% average recoveries over the last 2 years, with 24% in the most recent quarter.

- Recoveries are almost 1.9x the liquidation value, with lowest in July-Sept 2018 quarter (1.2x) and highest in Oct-Dec 2018 quarter (2.5x). (Refer to Chart 3)

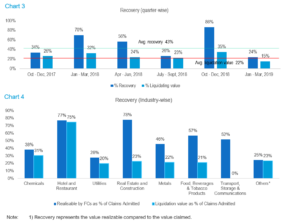

- Recoveries in the Real Estate and Construction sector is highest, followed by the Hotel Industry and Food and Beverage industry. A further sieve through the data, suggests that resolution plans yielded (as a multiple of liquidation value) lowest in the Hotel and Restaurant sector (1.03x) in comparison to other sectors. (Refer to Chart 4)

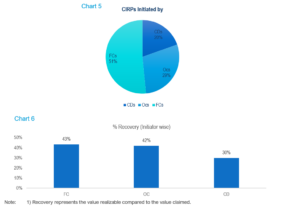

Analysis by initiators

- Under IBC, insolvency can be initiated by either financial creditors (FC) or operational creditors (OC) or corporate debtor (CD).

- CIRP initiated majorly by FCs (51%) followed by OCs (29%) and remainder by CDs (20%) (Refer to Chart 5)

- Recoveries were highest in CIRPs initiated by FCs at 43% followed by situations in which OCs initiated (42% recovery) and lowest at 30% recovery when CDs themselves filed for insolvency. (Refer to Chart 6)

Twelve Large Accounts

Overview

- Thereafter, on 13 June 107, RBI released a list of 12 companies constituting 25% of India’s total NPAs (Non-Performing Assets) under the name ‘Dirty Dozen’. Together they had an outstanding claim of Rs 3.45 lakh crore as against their liquidation value of Rs 73,220.23 crore

- These 12 shortlisted companies under the IBC that have fund/ non-fund exposure of above Rs 5,000 crore where 60 per cent or more has turned bad.

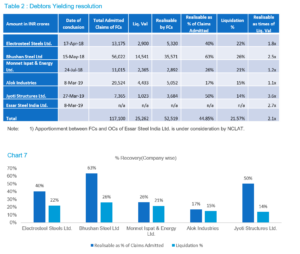

Resolution yielded

- As on 31st March 2019, of these 12 accounts under resolution process, six Corporate Debtors have been approved, and other accounts are at different stages of the process.

- The below six corporate debtors represent more than 70% of total claims realisable and more than 67% of total claims admitted under Corporate Insolvency Process.

- Recovery percentage for the six accounts was approximately 45%, in comparison to liquidation percentage of just 22%.

Debtors in process

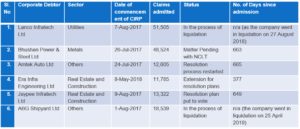

Lanco Infratech - In the process of liquidation

Lanco Infratech, the flagship company of the Lanco Group and once among the larger private players in the field of power and infrastructure engineering, procurement and construction (EPC), was posted for liquidation by the Hyderabad bench of the National Company Law Tribunal (NCLT) on 27th August 2018, a little over a year after the corporate insolvency resolution process (CIRP) was initiated on an application by IDBI Bank.

Bhushan Power & Steel Ltd - Matter Pending with NCLT

In February 2019, the committee of creditors of Bhushan Power and Steel Ltd (BPSL) has issued a letter of intent to India's largest private steelmaker JSW Steel Ltd, thus approving the latter's resolution plan for the distressed steel mill. JSW steel offered Rs 19,700 crore to lenders and infuse Rs 350 crore to revive the business. But the matter was taken to High court by the promoters of Bhushan Power & Steel Ltd. who claimed that the lenders did not provide them with the details of a resolution plan involving JSW Steel’s offer for the company. The court passed ex-parte orders on 18 April 2019, directing the National Company Law tribunal to hear the plea of the BPSL promoters.

Amtek Auto Ltd - Resolution process restarted

The resolution plan was earlier concluded on 25th July 2018, with UK-based Liberty House Group’s (LHG) offer of Rs 4,400, representing a recovery of about 34% of admitted FC claims. But the committee of creditors had approached NCLT after Liberty House failed to honour its payment commitments despite receiving the tribunal’s approval. Whereas Liberty House had, on its part, alleged “misrepresentation of facts" and discrepancies in valuation of the stressed asset.

The NCLT, in its final order on February 13, 2019, allowed the committee of creditors of Amtek Auto to start the resolution process from scratch. Further, NCLT said that the process should be completed within 150 days.

Era Infra Engineering Ltd - Extension for resolution plans

In March 2019, Lenders of Era Infra Engineering have got a 215-days extension from the National Company Law Tribunal (NCLT), which agreed to exclude those days from the stipulated duration of the insolvency process in response to an appeal, to prevent the company from going into liquidation.

The creditors approached the NCLT on the grounds that the insolvency process faced several stumbling blocks on account of investigations by the income tax authorities, making it difficult for prospective bidders to examine the company’s books of accounts, which were in the custody of the authorities.

The lenders so far received only one bid from Sun Pharmaceuticals, which was rejected by the lenders. The options now being examined include clubbing the insolvency process of some of the company’s subsidiaries with the parent in order to create a more valuable proposition for prospective buyers.

Jaypee Infratech Ltd - Resolution plan put to vote

Jaypee Infratech Ltd. offers construction services. The Company is in the business of constructing highways and commercial, industrial, institutional, residential and amusement complexes along the road. In 2017, the NCLT had admitted the application by an IDBI Bank-led consortium seeking resolution for Jaypee Infratech under the IBC. At that time, the company was expected to deliver residential apartments to homebuyers in Delhi prior to the insolvency move; the homebuyers approached the Apex Court seeking relief. While the Apex Court did not stop the insolvency proceedings, it did order that the committee of creditors must have representatives from the homebuyers, so that their interests are taken care of.

The newly constituted COC, received various bids from NBCC, Kotak Investment, L&T Infrastructure, Singapore-based Cube Highways and Suraksha group, recently.

All the bids were initially rejected. But the proposal of NBCC was revised during the current year; further COC decided to put it for a vote. As on date, the NBCC bid is on e-vote.

ABG Shipyard Ltd - In the process of liquidation

ABG Shipyard Ltd, once India’s biggest private shipbuilder, is headed for liquidation after a lenders panel rejected the resolution plan submitted by London-based Liberty House for the debt-laden shipbuilder. NCLT vide order dated April 25, 2019...ordered commencement of liquidation of ABG.

Closing thoughts

IBC has set up a time-bound resolution process for distressed companies which have defaulted on their obligations. Under this new insolvency regime, any of the three stakeholders (i.e. financial creditors, operational creditors and corporate debtor) can go to National Company Law Tribunal (NCLT), a quasi-judicial body in India that adjudicates issues relating to Indian companies.

The number of cases that are being admitted under IBC is consistently increasing since the new regime started in December 2016. However, in these initial years, only a handful of companies have concluded with a resolution plan (13% of total cases closed), and the rest (remaining 87%) have got either liquidated, settled or withdrawn.

For a healthy credit market, the percentage of cases concluding with a resolution plan should increase because the recoveries under resolution plan tend to be higher versus the same under liquidation as evident from the data (December 2016 to 31 March 2019): average recoveries under resolution plan were 43% which was almost 1.9x its calculated liquidation value.