Foreword

If India is successful in becoming a $5 trillion economy in the next five years, amongst many other things, even capital markets and asset management industry could see a positive tectonic shift in the next decade.

There has been a lot of noise that the world is moving “out” of active management and “into” passive management. This may hold true for a developed market nation like the US. However, everything that holds true for a developed market nation may not hold true for an emerging market nation like India. India’s asset management industry is at a very nascent stage when we compare to a mature market like the US.

In this paper, we have discussed an overview of asset management companies (AMCs), top AMCs in India, trends and events which led to a recent listing in India and methods to value such businesses along with current valuation and financial performance of Indian AMCs and a comparison with US-listed asset managers.

We note that “a lot has to happen” in the Indian asset management industry in decades to come before active portfolio management hits “upper circuit” in any kind of proportions near to what we are currently seeing in the US. One trend in times to come could be more asset managers taking the IPO route in India to provide liquidity to existing investors and create a more prominent and visible brand name for their asset management company.

Background

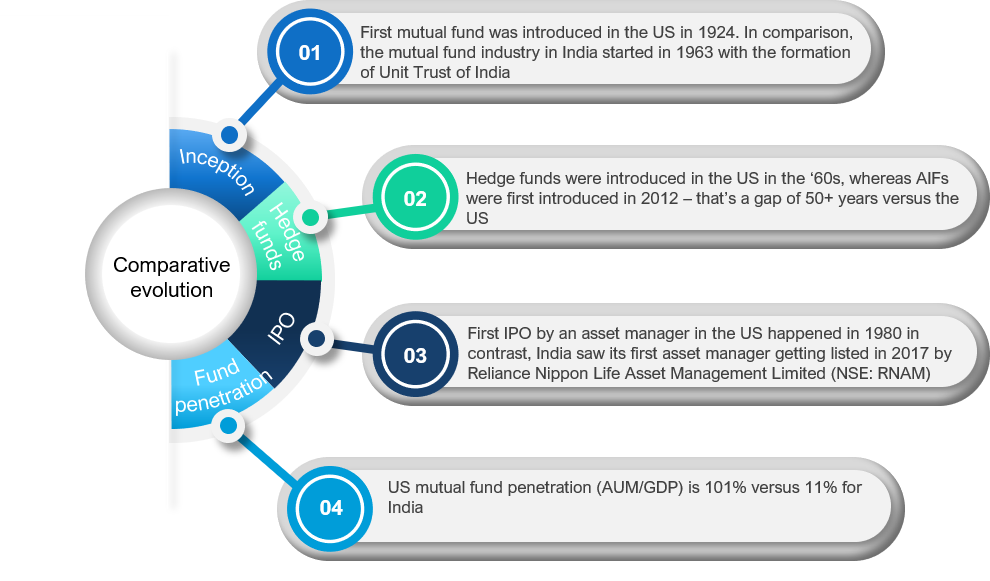

India’s asset management industry is at a very nascent stage when we compare to a mature market like the US. Let us see a few numbers to put this into perspective:

- First mutual fund was introduced in the US in 1924 - MFS Massachusetts Investors Fund (MITTX). In comparison, the mutual fund industry in India started in 1963 with the formation of Unit Trust of India, at the initiative of the Government of India and Reserve Bank of India. However, 1987 marked the entry of non-UTI, public sector mutual funds set up by public sector banks and Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC); that’s almost a gap of 65 years versus the US

- By the time India saw its first mutual fund in the 80s, the US had already moved up the ladder to alternative assets like hedge funds. Hedge funds were introduced in the US in the ‘60s and were a sophisticated asset class by the ‘80s. In the Indian context, the nearest comparable asset class to hedge funds of the US are the Alternative Investment Funds (AIFs). AIFs were first introduced in 2012 – that’s a gap of 50+ years versus the US

- First initial public offering (IPO) by an asset manager in the US happened in 1980 by State Street Corporation (NYSE: STT), and India saw its first asset manager getting listed in 2017 by Reliance Nippon Life Asset Management Limited (NSE: RNAM) – that’s a gap of 37 years versus the US

- US mutual fund penetration (AUM/GDP) is 101% versus 11% for India and US has several listed AMCs with more trillion dollars of AUM versus India’s entire mutual fund industry’s (listed + unlisted) AUM is currently standing at c.USD 370 Bn

India’s AMCs evolution timeline compared to the US

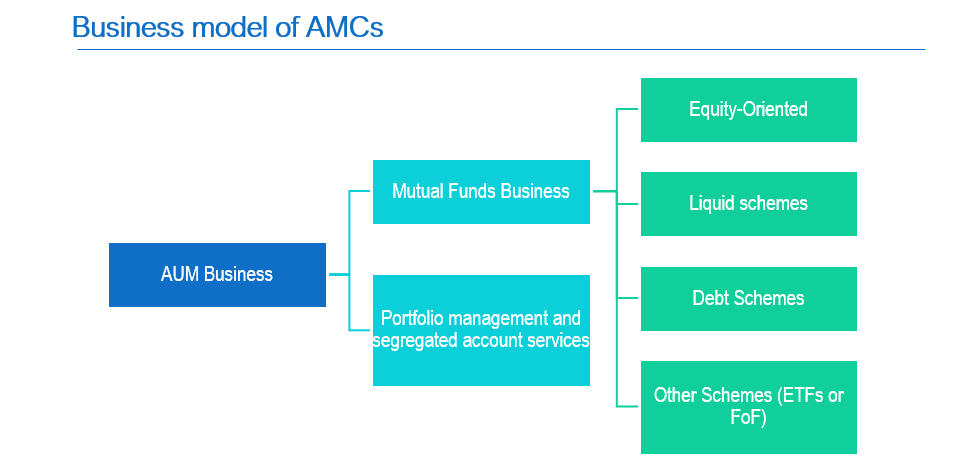

Overview of AMCs

- The Asset management companies in India majorly provide two types of services: Mutual Fund Services and Portfolio Management Services (PMS)

AMC companies offer their customers access to their products and services through an extensive multi-channel sales and distribution network comprising banks, national distributors and independent financial advisers (IFAs).

These companies generate a substantial amount of revenue from investment management fees that are charged as a percentage of annual average asset under management (“AAAUM” or “AUM”).

Growth in AUM is a function of volume and price. In other words, AUM is “number of units” multiplied by “net asset value (NAV)”. Volume increases with an increase in net inflows (net of redemptions) which can take the route of either one-time lump sum inflow or via periodic systematic investment plan (SIP). Price or NAV increase when the prices of the underlying assets which are held by the AMC, increase.

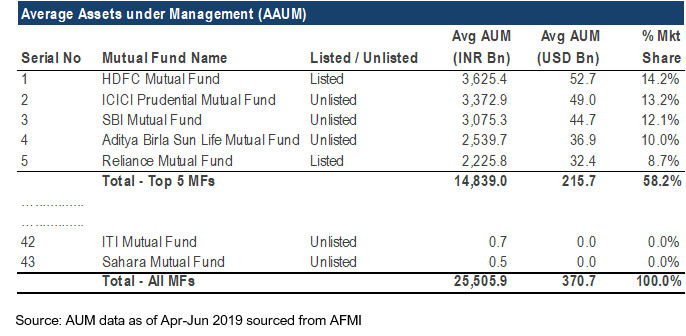

Top AMC players in India

- There are around 43 AMCs providing traditional mutual fund offerings with a combined AUM of approximately INR 25.5 trillion (USD 370 Bn) as of Apr-Jun 2019 based on the average AUM data. Top five AMCs roughly constitute 60% of the overall market size with HDFC Mutual Fund being the largest AMC with INR 362.5 trillion (USD 52.7 Bn) representing 14% market share.

- Currently, two of these asset managers are listed: Reliance Nippon Life Asset Management Limited (NSE: RNAM) was listed in November 2017, and HDFC Asset Management Company Ltd (NSE: HDFCAMC) was listed in August 2018.

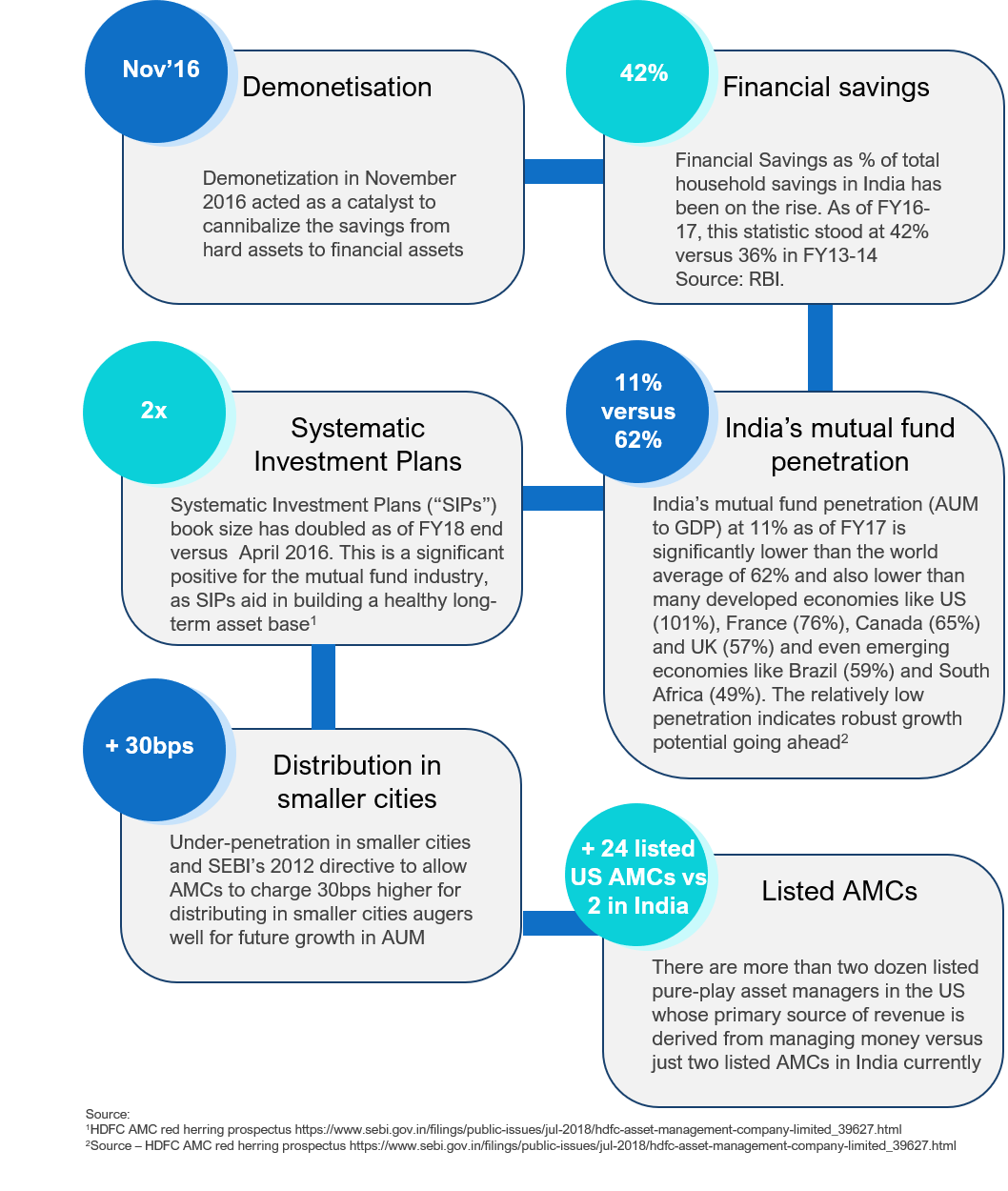

Trends and Data in Indian AMC sector which could fuel more AMCs going for IPO in future

It is essential to analyse the events and macro trends which could have possibly helped two of the largest AMCs in India going for IPO in a span of the last two years:

Key Performing Indicators for valuing an AMC

- Size of AUM: The higher the size of AUM, the better it is, for it results in higher fees.

- Weighted average management fees: An AMC which is able to charge higher management fees will generate higher revenues and profits on the same asset base.

- Product mix: Debt schemes tend to have a lower management fee versus equity schemes and hence AUMs with higher % derived from equity schemes tend to have higher valuation multiples versus other similar AMCs with lower equity AUM. Further, higher AUM from liquid schemes as % of total AUM tend to attract lower valuation multiples versus other similar AMCs with lower AUM from liquid schemes

- Monthly and annual SIP flows: Regular flow of investments through systematic investment plans (SIPs) show investors' belief in the AMC's ability to generate consistent returns which provide certainty to the future profitability of the company.

- SIP AUM as a per cent of equity AUM: Systematic investments mean a steady flow of assets to an AMC. A higher share of SIP AUM in the total equity AUM leads to predictable cash flows for the AMC.

- Distribution channels: Higher customer reach through distribution and channel partners tend to have higher valuations versus another AMC with lower out-reach

Valuation approaches and methodologies

- Broadly, three approaches are used for valuing AMCs:

- Income approach: Under the income approach, one or both of the following methodologies are used to value an AMC: a) discounted cash flow (DCF) methodology, b) Price-earnings capitalization method (PECV)

- Market approach: Under the market approach, both comparable companies (CoCo), as well as comparable transactions (CoTrans), are widely used to value AMCs. Valuation multiples like EV as % of AUM, EV/EBITDA are most relevant for evaluating an AMC business. AMCs with higher asset balances, fee structures, and profit margins typically attract higher AUM multiples in the marketplace.

- Statistical approach: There are few statistical approaches like HUBERMAN and BERK/GREEN, which are also used to value asset managers. These two approaches use the dividend discount model and simple cross-sectional model, respectively. These methods can be used to validate the output under the income/market approach

- We have analysed valuations in the sector and have also made a comparison with international peers. We have looked into the following valuation metrics and evaluated against drivers like the size of AUM, revenue as % AUM, EBITDA margin and net profit margin:

- Mkt Cap / AUM & EV / AUM expressed as percentage

- P/E and P/BV multiples

- EV/EBITDA multiples

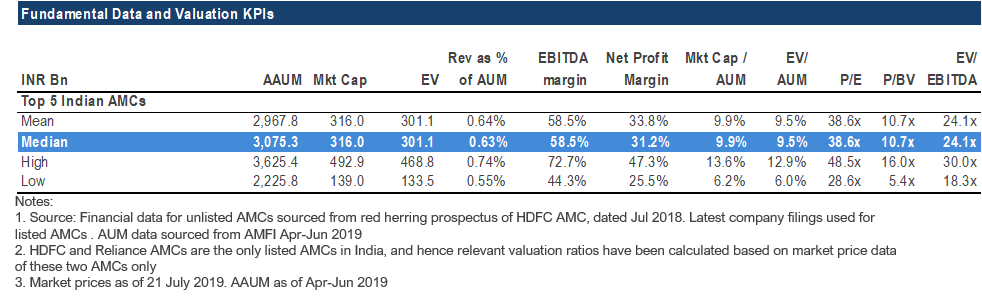

Top Indian AMCs - Valuation multiples and financial KPIs

Key observations:

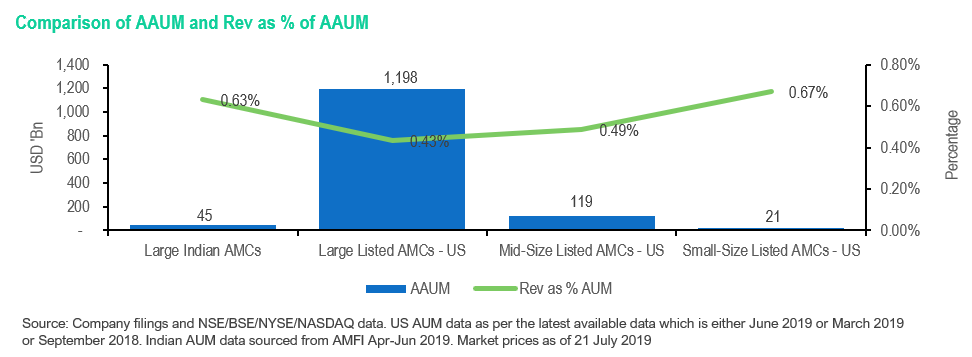

- Revenue as % AAUM for the median of Top 5 AMCs is 0.63% with a minimum of 0.55% and a maximum of 0.74%.

- The net profit margin for these five AMCs is having a median of 31% and is ranging between 25-47%

- Valuation ratios of P/BV, EV/EBITDA and Mkt Cap as % AUM are being driven by a combination of the size of AUM, the contribution of equity schemes and margin earned in the business. P/BV ratio is trading in a wide range of 5-15x. Similarly, Mkt Cap as % AUM is also trading in a wide range of 6-14%

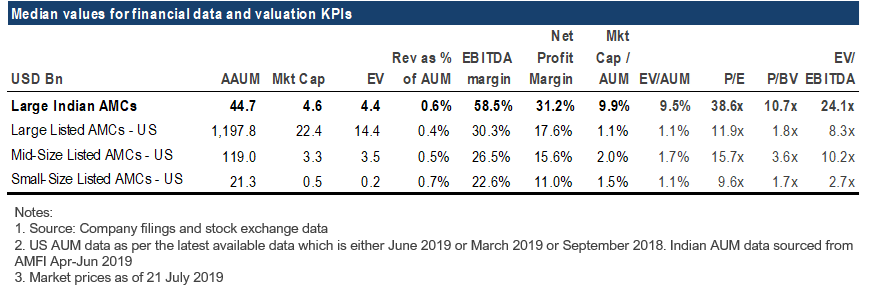

Comparison with International peers - Valuation multiples and financial KPIs

There are more than two dozen listed asset managers in the US whose primary business is managing money. Beyond such asset managers, there are several others whose principal focus is private equity / direct lending / structured credit products. In our analysis, we have only included asset mangers who majorly deal in managing money.

Equity oriented AUM for the US AMCs considered in the above analysis is around 50% which is broadly in line with top Indian AMCs having equity-oriented schemes between 40-50%

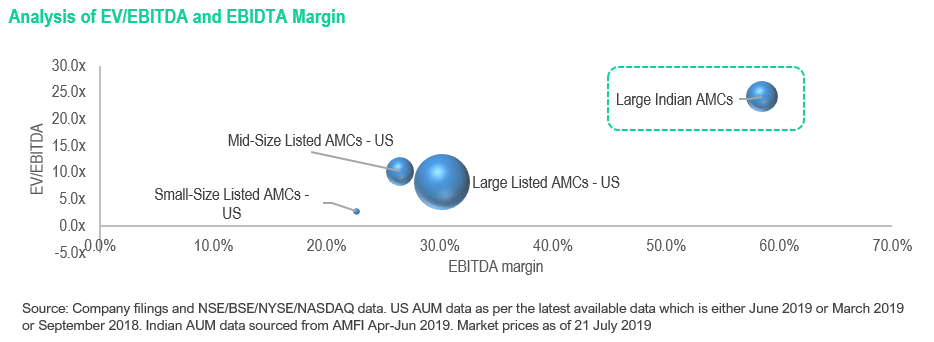

We identified 23 listed asset managers in the US and divided into “Large”, “Mid-Size” and “Small-Size” asset mangers using market capitalization (<USD 1 Bn as Small-Size, Between USD 1-10 Bn as Mid-Size and >USD 10 Bn as Large).

Key observations:

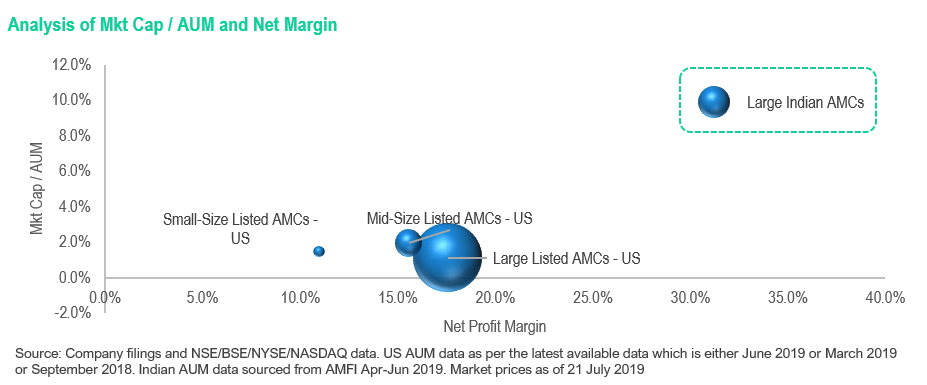

India’s large AMCs have a median AUM of USD 45 Bn and Mkt Cap of USD 4.4Bn. In terms of AUM, India’s large AMCs falls between the small and mid-size listed AMCs of the US and in terms of Mkt Cap, the same falls between small and medium-sized US-listed AMCs.

The net profit margin for the US asset managers measured by median numbers of the three sub-segment noted above ranges between 10-18% versus +30% margin for large Indian AMCs

US asset managers valuation as measured by Mkt Cap / AUM is between 1-2% versus 10% for Indian AMCs

Comparison with International peers - Valuation multiples and financial KPIs

Closing thoughts

Indian Government is focused on making India a USD 5 trillion economy in the next five years. This will require a higher investment rate and increase in consumption to mobilize all the sectors along with a supportive fiscal and monetary policy. Mutual fund assets as a percentage of GDP is fairly low versus the global average. If the economy moves in the direction as per Indian Government’s vision, mutual fund assets could have a tectonic shift in the next decade. This could incentivize more asset managers to go for IPO. Valuation for the Indian asset managers has been more compelling when compared to the US peers partly driven by an early stage of active management wave in India versus mature passive management in the developed countries like the US. This could act as a boost for the listing of AMCs in India in years to come

Disclaimer

This publication has been carefully prepared only for education purpose and is not a research report or any kind of investment advice. Neither authors of this publication nor Incwert Advisory Private Limited have any kind of conflict of interest with any company / firm / entity which have been cited and have been used for the sole purpose of illustration. It has been written in general terms and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. It should be seen as broad guidance only and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice after a thorough examination of the particular situation. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this proposal, and, to the extent permitted by law, Incwert Advisory Private Limited (“Incwert”), its members, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. Without prior permission of Incwert, this publication may not be quoted in whole or in part or otherwise referred to in any documents.