Authored by: CA Sunit Khandelwal & CA Punit Khandelwal

Assisted by: CA Megha Sareen & Sarthak Garg

Foreword

We are pleased to come out with our India Control Premium Study 2019 based on the analysis of public transactions which triggered open offer obligations on the acquirer during March 2002 to June 2019, culminating into an extensive study of 17+ years of premium in takeovers.

A Control Premium is the additional consideration that an investor would pay over a marketable minority equity value (i.e., current, publicly-traded stock prices) to own a controlling interest in the common stock of a company. In the case of India, the reference to base price was drawn based on the offer price guidelines set in the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011.

In this paper, we have presented Control Premium in the mergers & acquisitions of Indian companies segregated by industry, time series and different bases of premium. The analysis and statistics are only estimates, and it is important to consider the characteristics of the likely market participants and the level of improvements to the cash flows and synergies available to these market participants when estimating premium for a specific company.

The statistics reflect median/averages over a wide range and note that the actual premium paid in any given transaction depends upon the negotiation dynamics.

We hope you find the results of our study of interest and value.

Our methodology - Overview

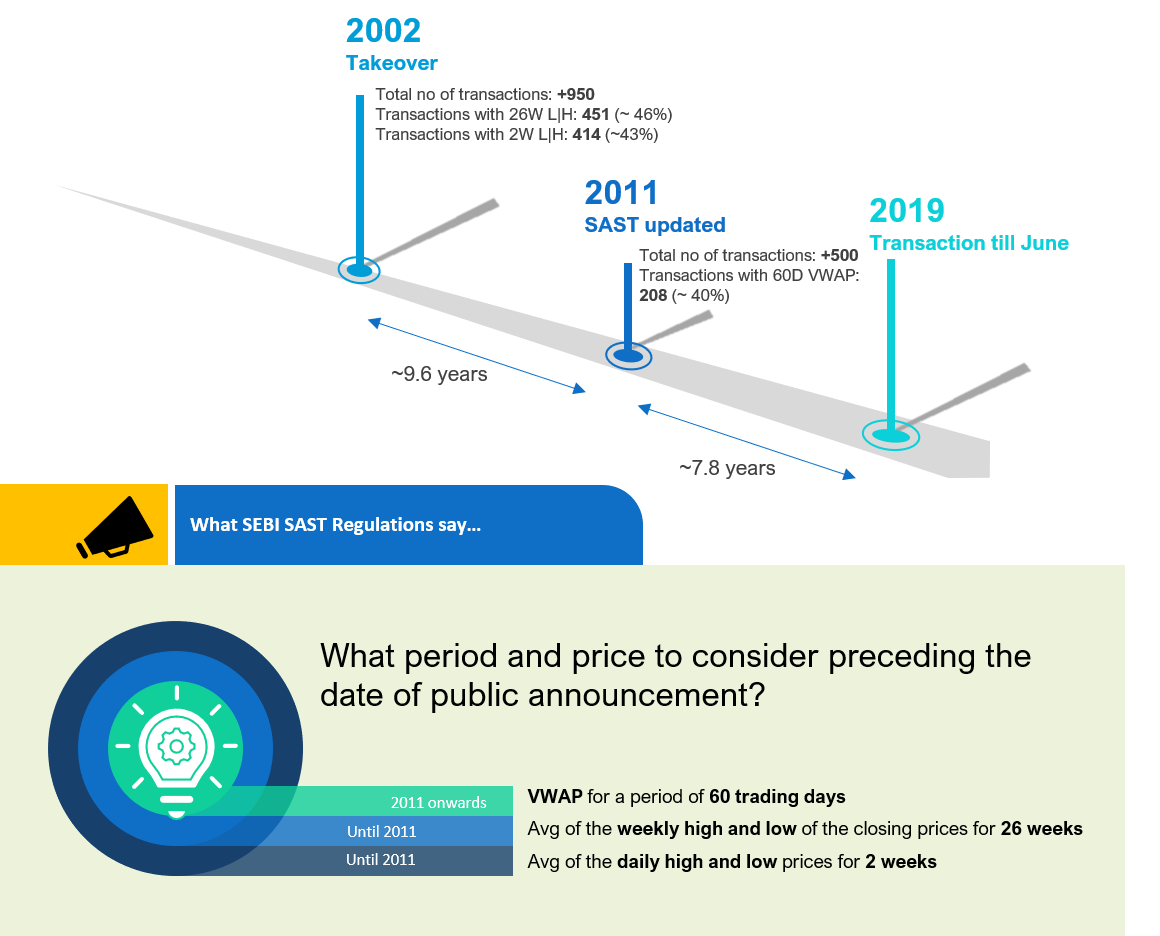

- We have analysed the details of takeover transactions available with the Securities and Exchange Board of India (SEBI) for an extensive 17-year period from 2002 until June of 2019, covering offer price-related data of over 1,400 transactions.

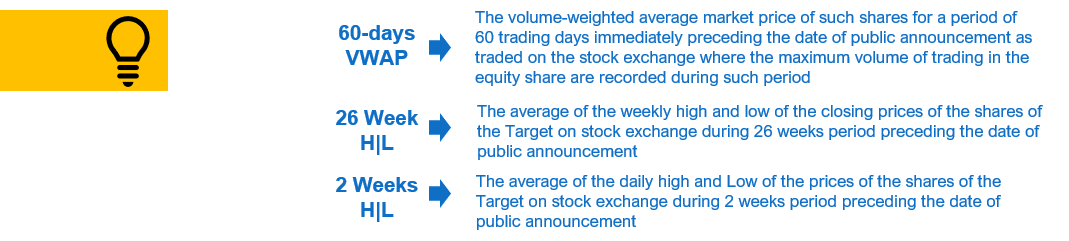

- Public announcement or letter of offer was reviewed to understand the justification of offer price by the acquirer for taking over the target company. Where the annualised trading turnover of the target company’s shares traded during the twelve calendar months preceding the month of the public announcement was 10 per cent or more, the details of 60-days VWAP or 26 Week H|L or 2 Weeks H|L (depending on the extant SAST Regulations) were disclosed.

- The implied control premium (i.e. [Offer price less Base price]/Base price) has been computed on 60-days VWAP or 26 Week H|L or 2 Weeks H|L as available.

- In the 1,400+ transactions that we analysed, 208 transactions disclose the 60-days VWAP, 451 transactions disclose the 26 Week H|L (i.e. the average of the weekly high and low of the closing prices during 26 weeks prior to the public announcement) and 414 transactions disclose 2 Weeks H|L (i.e. average of the daily high and low prices during 2 weeks period preceding the date of public announcement). The other transactions that do not disclose these details were where the target company was not frequently trading. Also, in certain situations, only the 26 Week H|L was reported where the stock did not trade during the last 2 weeks before the announcement.

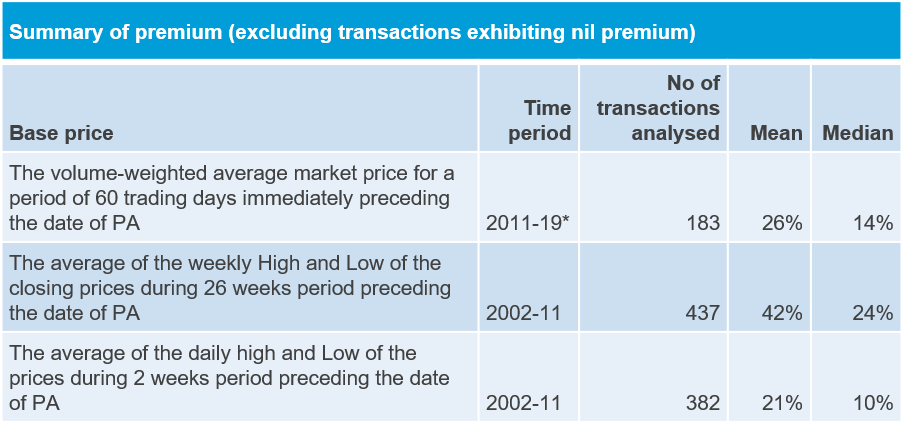

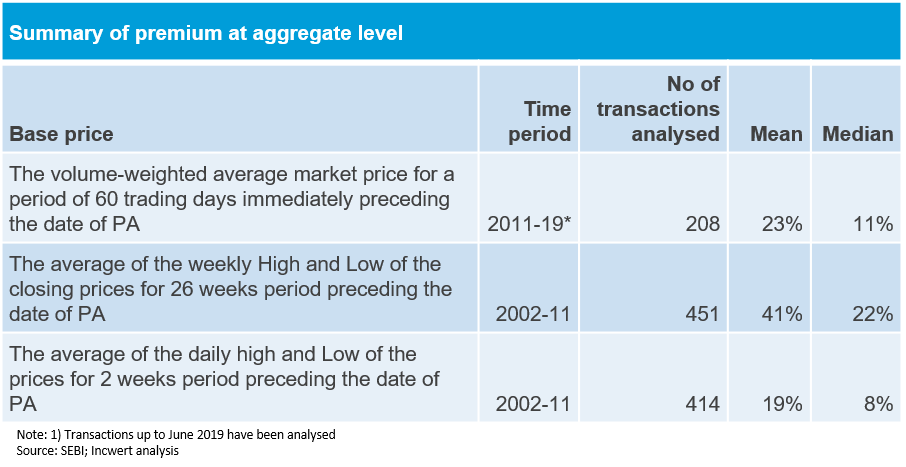

- The implied control premium is nil for transactions where the offer price is equivalent to the base price (60-days VWAP or 26 Week H|L or 2 Weeks H|L). As such, in our analysis, we have presented both control premium on an aggregate level and after excluding transactions that exhibit nil premium.

- 26 Week H|L or 2 Weeks H|L as available is considered as the base price for transactions prior to November 2011 and after that 60-days VWAP is considered as the base price.

Methodology – What SEBI (Substantial Acquisition of Shares and Takeovers) Regulations stipulate as Base price for takeovers in India…..

SEBI SAST Regulation, 2011

The extant Takeover regulation in India requires an acquirer to offer the highest of the following :

1)Highest negotiated price per equity share for any acquisition in terms of the SPA attracting the obligation to make the public announcement (“PA”)

2)The volume-weighted average price paid or payable for acquisition by the Acquirer or by any person acting in concert with it, during the 52 weeks immediately preceding the date of PA

3)The highest price paid or payable for any acquisition by the Acquirer or by any person acting in concert with it, during the 26 weeks immediately preceding the date of the PA

4)The volume-weighted average market price of such shares for a period of 60 trading days immediately preceding the date of PA as traded on the stock exchange where the maximum volume of trading in the equity shares is recorded during such period

SEBI SAST Regulation, 1997

1)The negotiated price

2)Highest Price paid by the acquirer for acquisition, if any, including by way of allotment in a public or rights issue or Preferential Issue during the 26 weeks prior to the date of the PA

3)The average of the weekly high and low of the closing prices of the shares of the Target on the stock exchange during 26 weeks period preceding the date of PA

The average of the daily high and Low of the prices of the shares of the Target on the stock exchange during 2 weeks period preceding the date of PA

Methodology - Base price considered for computing the Control Premium

- In our analysis, we have segregated the observable period into two parts – a) year 2002 to October 2011 and b) November 2011 to June 2019

- Prior to November 2011, for target companies that were frequently traded, public announcement or letter of offer disclosed both a) the average of the weekly high and low of the closing prices during 26 weeks prior to the public announcement and b) average of the daily high and low prices during 2 weeks period preceding the date of public announcement as a determiner of the offer price.

- However, owing to several factors such as the growth of M&A activity in India as the preferred mode of restructuring, the increasing sophistication of takeover market, the decade long regulatory experience and various judicial pronouncements, it was felt necessary to review the SAST Regulations 1997. Accordingly, SEBI in the SAST Regulations, 2011 modified the offer price determiner to the volume-weighted average market price of shares for a period of sixty trading days.

- Thus, from November 2011 to June 2019, the base price considered is 60-days VWAP.

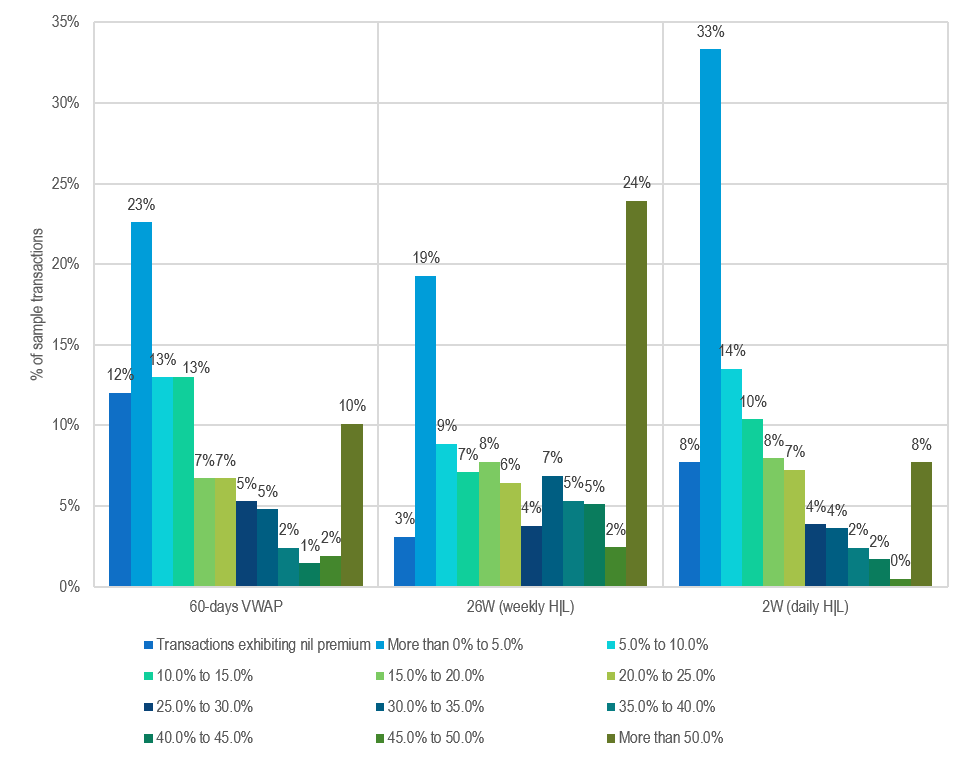

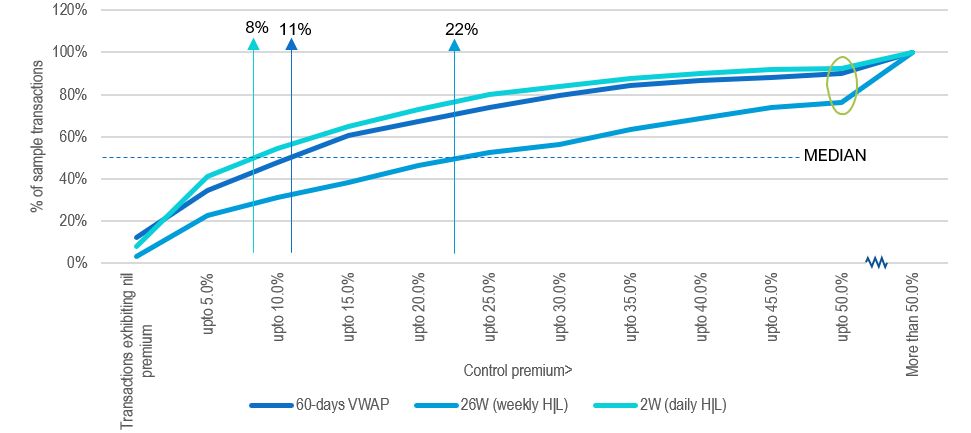

Summary of control premium on different price bases

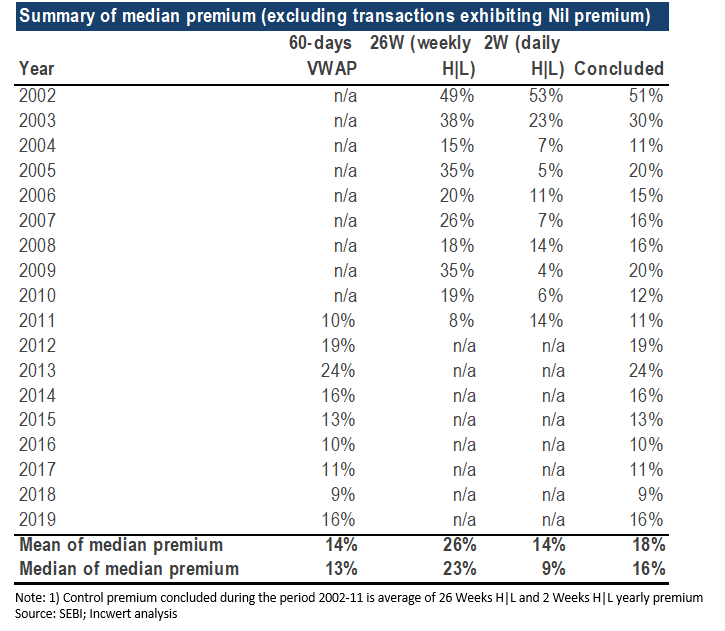

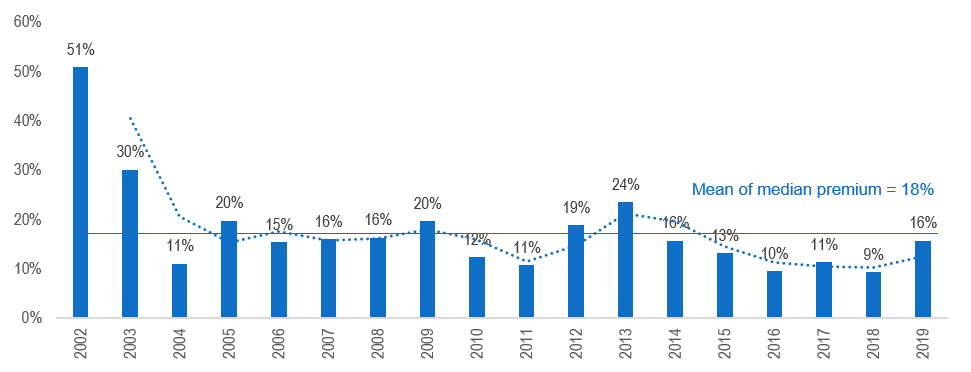

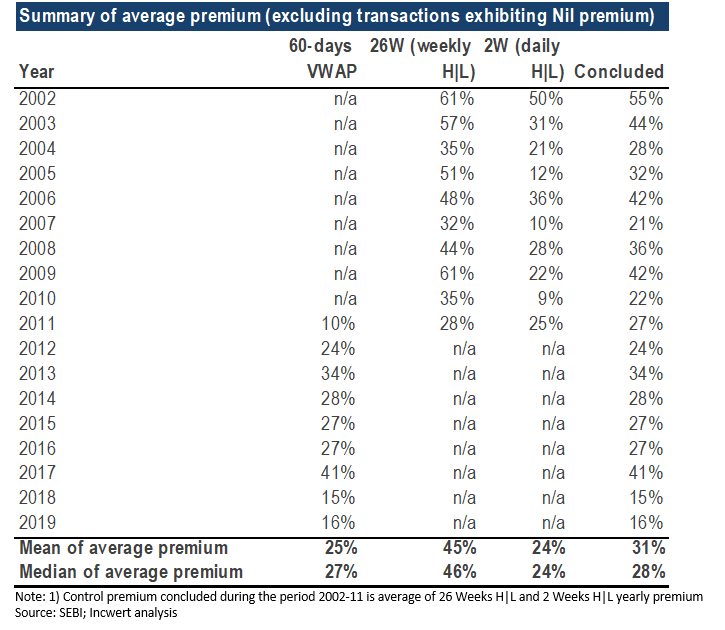

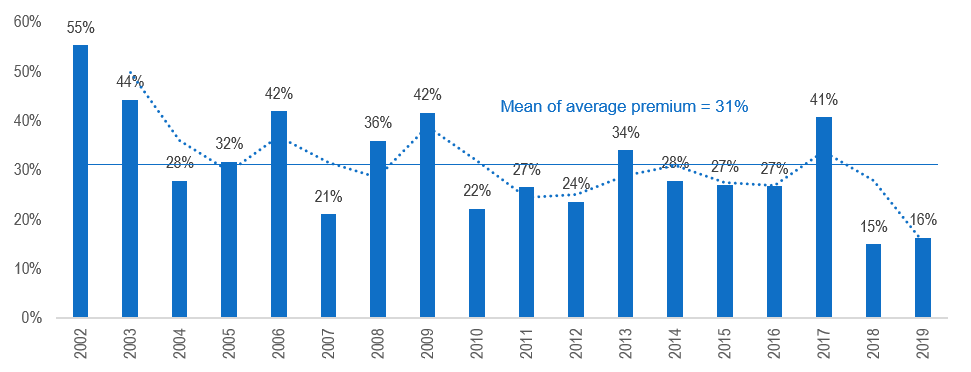

- The average and the median control premium (excluding transactions exhibiting nil premium) for the period 2011-19 is observed to be 26% and 14% based on 60-days VWAP as the base price. During the period 2002-11, the average and the median control premium is observed to be 42% and 24% based on 26 Weeks H|L as a base and 21% and 10% based on 2 Weeks H|L as the base price.

- The transactions that display nil premium are the ones where price run-ups post potential information leakage would have resulted in market price rising higher than the highest negotiated price or the 52 weeks VWAP price paid by the acquirer, or the 26 weeks highest price offered by the acquirer. Furthermore, we also see nil premium in indirect acquisitions where offer price is set equivalent to the market price.

ANALYSIS BY INDUSTRY

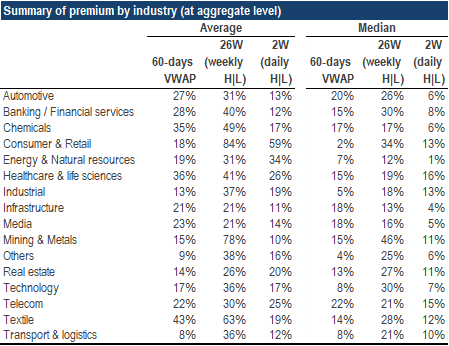

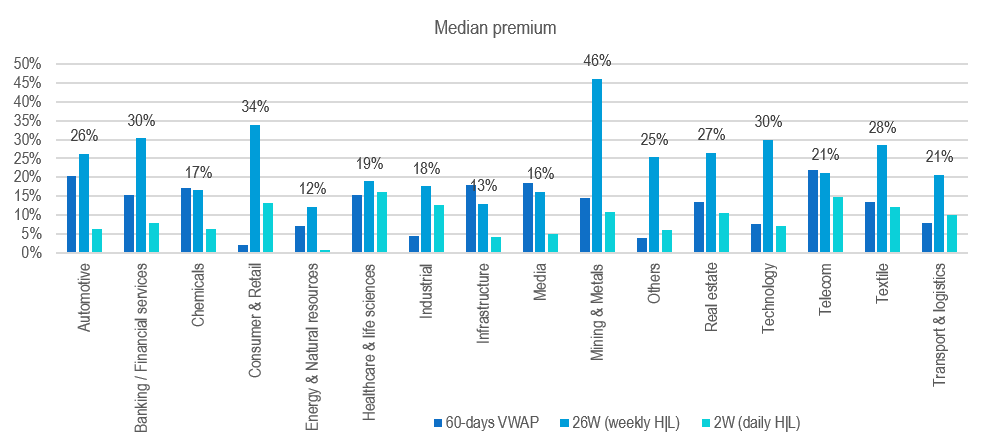

Summary of Control Premium by industry (at an aggregate level)

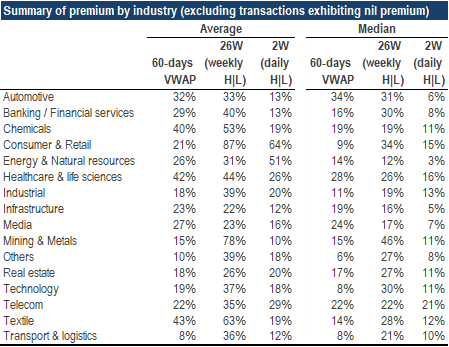

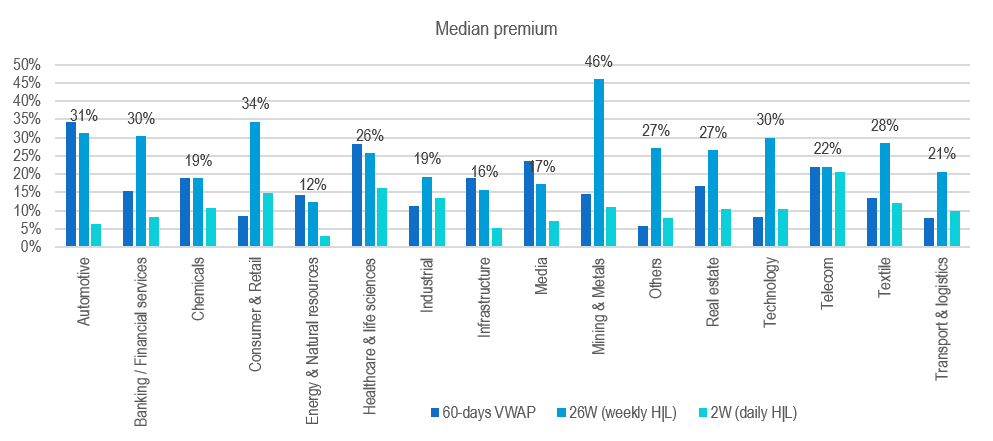

Summary of Control Premium by industry (excluding transactions exhibiting nil premium)

ANALYSIS BY TIME SERIES

Time series analysis of median Control Premium

Time series analysis of average Control Premium

DISTRIBUTION ANALYSIS OF CONTROL PREMIUM

Control Premium is positively skewed with 75% to 90% of the sample exhibiting premium less than 50%

This publication has been carefully prepared only for education purpose and is not a research report or any kind of investment advice. Neither authors of this publication nor Incwert Advisory Private Limited have any kind of conflict of interest with any company/firm/ entity which have been cited and have been used for the sole purpose of illustration. It has been written in general terms and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. It should be seen as broad guidance only and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice after a thorough examination of the particular situation. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this proposal, and, to the extent permitted by law, Incwert Advisory Private Limited (“Incwert”), its members, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. Without prior permission of Incwert, this publication may not be quoted in whole or in part or otherwise referred to in any documents.