Authored by: CA Punit Khandelwal & CA Sunit Khandelwal

Assisted by: CA Gargi Gupta

Foreword

The RBI had issued a circular in February 2016 requiring banks to implement Indian Accounting Standards (Ind AS) and prepare standalone and consolidated Ind AS financial statements with effect from 1 April 2018. However, the RBI in its press release issued on 5 April 2018 deferred the applicability of Ind AS by one year (i.e. 1 April 2019) for Scheduled Commercial Banks. Further, RBI in a circular issued on 22 March 2019 deferred the implementation of Ind AS till further notice.

Similarly, implementation of Ind AS in the Insurance sector has also been deferred, and IRDAI shall decide the date of application after the finalisation of IFRS 17 by IASB (IRDAI/F&A/CIR/ACTS/023/01/2020 Date: 21 January 2020).

While the postponement has provided some relief to the Banks and Insurance companies, we considered it to be appropriate to utilise this temporary deferral to analyse select business combinations that have occurred in the banking and insurance sector in the USA up to 31 December 2019.

Ind AS driven PPA disclosures (Ind AS 103) have a lesser history in the BFSI sector driven by a smaller number of business combination transactions in this sector. We, therefore, believe that it might be a good idea to explore the more mature US market for drawing inferences that can provide guiding sticks for deal reporting in India.

We hope you find the results of our study of interest and value.

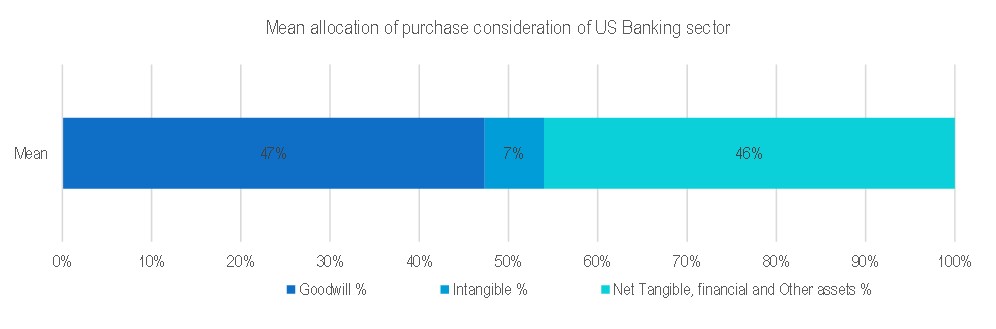

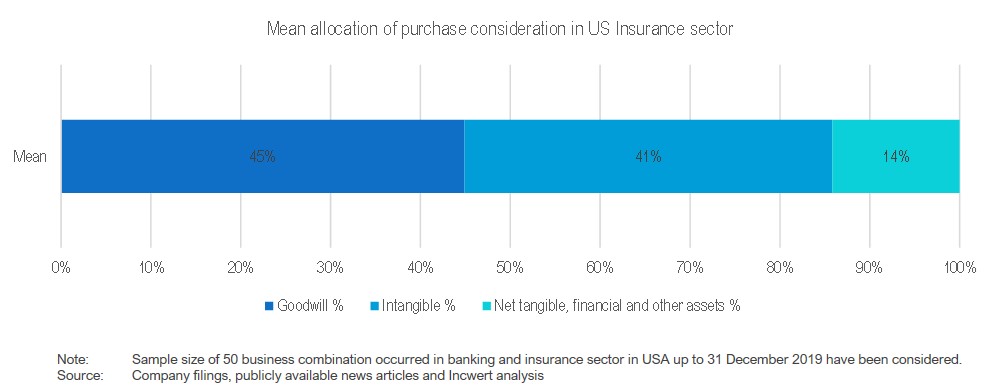

Around 45-47% of the purchase consideration is towards goodwill in both, banking and insurance sectors. However, allocation of identified intangible assets in the insurance sector (41%) is significantly higher than the banking sector (7%)

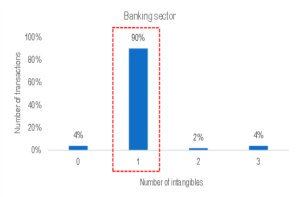

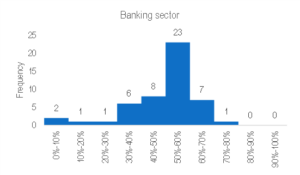

In the US banking sector, we noted that 47% of the purchase consideration is allocated towards goodwill, 7% is allocated towards identified intangible assets and balance 46% towards identified tangible assets in the banking industry.

In the US insurance sector, 45% of the purchase consideration is allocated towards goodwill, 41% is allocated towards identified intangible assets and balance 14% towards tangible assets.

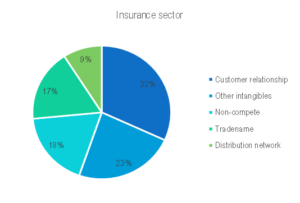

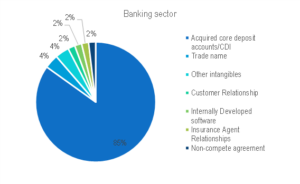

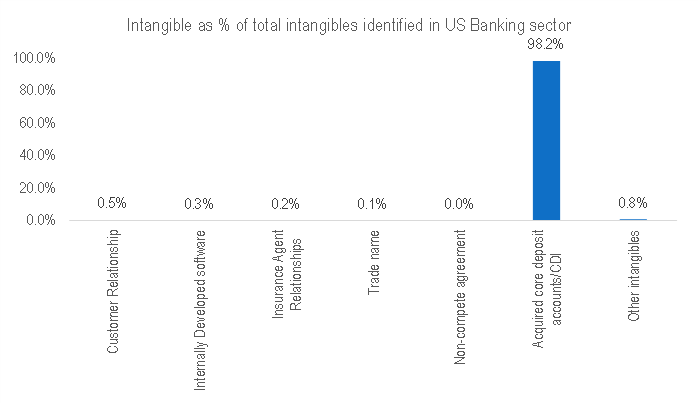

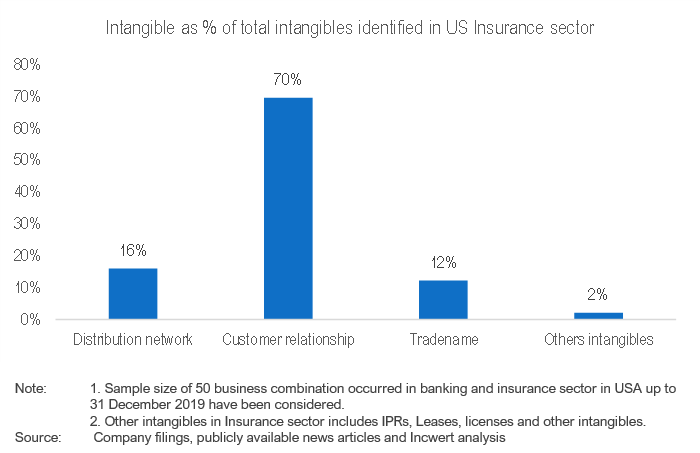

‘Core deposit accounts’ (98%) and customer relationships (70%) constitute the largest portion of identified intangible assets in the US banking and insurance sectors respectively

Core deposit accounts/CDI constitute the largest portion (98%) of identified intangibles in the banking sector of the US. It is recognized when a bank has a well-balanced deposit base comprised of funds associated with long term customer relationships.

Customer relationship constitutes the largest portion (70%) of identified intangibles in the insurance sector of the US. It is the fundamental value driver of an insurance company which is basically the in-force contracts already existing in the business.

Key findings

Overview of our methodology

- For the banking sector, we have analysed top 50 business combinations that occurred in the USA during the past 2 years ending 31 December 2019. For certain transactions, only the total value was disclosed for all the intangibles recognised. For such cases, the value of intangibles was assigned to core deposit intangibles.

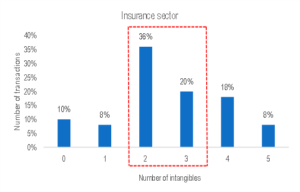

- For the Insurance sector, the business combinations that occurred during the past 10 years ending 31 December 2019 were analysed. The transactions with a purchase price exceeding USD 25 million were considered. A total number of 50 transactions were identified where adequate information about PPA was disclosed. Appropriate assumptions were considered with regard to intangibles where the full information was not disclosed.

Why is BFSI sector unique?

Financial service firms have much in common with non-financial service firms. They attempt to be as profitable as they can, must worry about competition and want to grow rapidly over time. But there are a few points which make them unique from non-financial service firms:

- Capital of non-financial service firm includes both debt and equity. But with financial service firm, debt seems to take a different connotation. Rather than treating debt as a source of capital, most financial firm seems to treat it as a raw material. Therefore, capital at financial service firms seems to be more narrowly defined as including only equity capital.

- Financial service firms are heavily regulated all over the world, though the extent of the regulations varies from country to country.

Disclaimer:

This publication has been carefully prepared only for general information and education purpose and is not a research report or any kind of investment advice. Neither authors of this publication nor Incwert Advisory Private Limited have any kind of conflict of interest with any company/firm/entity which has been cited and have been used for the sole purpose of illustration. It has been written in general terms and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. It should be seen as broad guidance only and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice after a thorough examination of the particular situation. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this proposal, and, to the extent permitted by law, Incwert Advisory Private Limited (“Incwert”), its members, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.