Authored by: CA Punit Khandelwal & CA Sunit Khandelwal

Assisted by: CA Allen Vincent

Foreword

The second edition of Incwert’s India Control Premium Study, 2020 is an update to the previous year’s study. The study analyses 18+ years (March 2002 to June 2020) of premium offered in takeovers in public transactions which triggered open offer obligations on the acquirers.

A Control Premium is the additional consideration that an investor would pay over a marketable minority equity value (i.e., current, publicly-traded stock prices) to own a controlling interest in the common stock of a company. In the case of India, the reference to base price was drawn based on the offer price guidelines set in the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011.

The paper presents the Control Premium in the mergers & acquisitions of Indian companies segregated by industry, time series and different bases of premium. The analysis and statistics are only estimates, and it is important to consider the characteristics of the likely market participants and the level of improvements to the cash flows and synergies available to those market participants when estimating premium for a specific company.

The statistics reflect median/averages over a wide range and note that the actual premium paid in any given transaction depends upon the negotiation dynamics.

We hope you find the results of our study of interest and value.

Our methodology - Overview

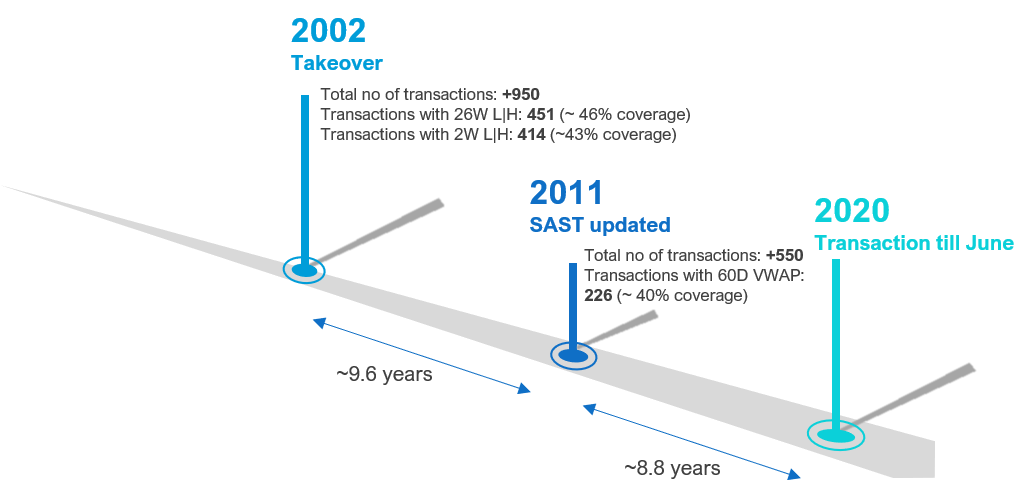

- We have analysed the details of takeover transactions available with the Securities and Exchange Board of India (SEBI) for an extensive period of 18+ years from March 2002 until June of 2020, covering offer-price related data of over 1,500 transactions.

- Public announcement or letter of offer was reviewed to understand the justification of offer price by the acquirer for taking over the target company. Where the annualised trading turnover of the target company’s shares traded during the twelve calendar months preceding the month of the public announcement was 10 per cent or more, the details of 60-days VWAP or 26 Week H|L or 2 Weeks H|L (depending on the extant SAST Regulations) were disclosed.

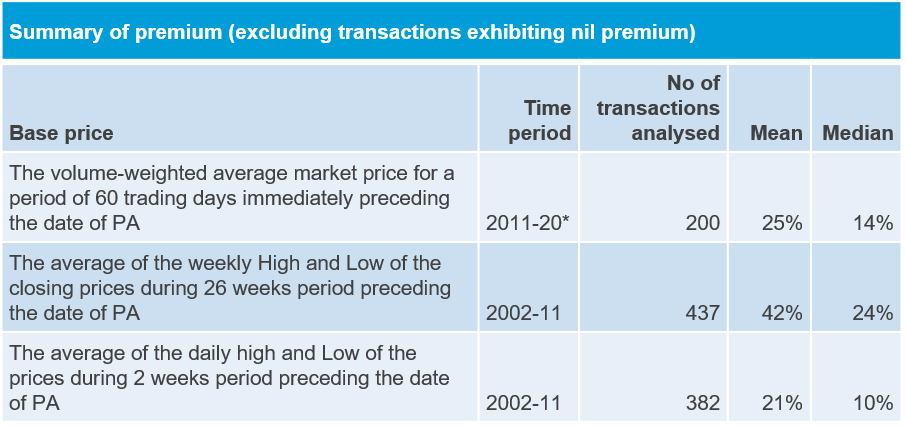

- The implied control premium (i.e. [Offer price less Base price]/Base price) has been computed on 60-days VWAP or 26 Week H|L or 2 Weeks H|L as available.

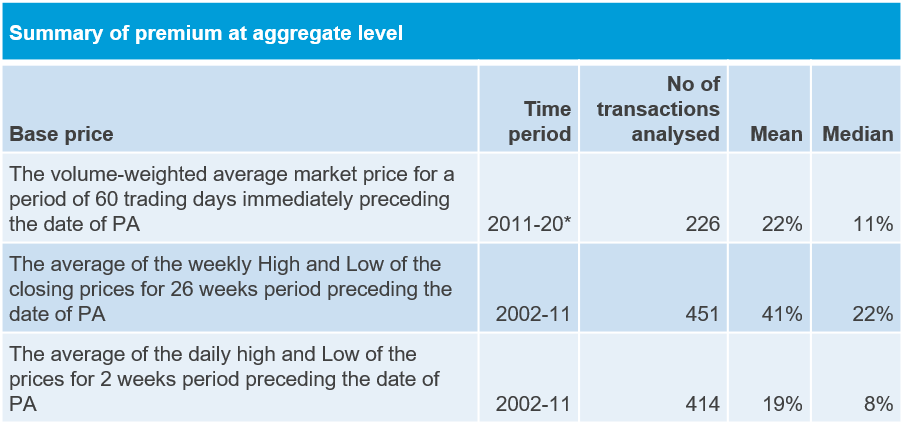

- In the 1,500+ transactions that were analysed, 226 transactions disclose the 60-days VWAP, 451 transactions disclose the 26 Week H|L (i.e. the average of the weekly high and low of the closing prices during 26 weeks prior to the public announcement) and 414 transactions disclose 2 Weeks H|L (i.e. an average of the daily high and low prices during 2 weeks period preceding the date of public announcement). The other transactions that do not disclose these details were where the target company was not frequently trading. Also, in certain situations, only the 26 Week H|L was reported where the stock did not trade during the last 2 weeks before the announcement.

- The implied control premium is nil for transactions where the offer price is equivalent to the base price (60-days VWAP or 26 Week H|L or 2 Weeks H|L). As such, in our analysis, we have presented both control premium on an aggregate level and after excluding transactions that exhibit nil premium.

- 26 Week H|L or 2 Weeks H|L as available is considered as the base price for transactions prior to November 2011 and after that 60-days VWAP is considered as the base price.

Base price considered for computing the Control Premium

- In our analysis, we have segregated the observable period into two parts – a) year 2002 to October 2011 and b) November 2011 to June 2020

- Prior to November 2011, for target companies that were frequently traded, public announcement or letter of offer disclosed both a) the average of the weekly high and low of the closing prices during 26 weeks prior to the public announcement and b) average of the daily high and low prices during 2 weeks period preceding the date of public announcement as a determiner of the offer price.

- However, owing to several factors such as the growth of M&A activity in India as the preferred mode of restructuring, the increasing sophistication of takeover market, the decade long regulatory experience and various judicial pronouncements, it was felt necessary to review the SAST Regulations 1997. Accordingly, SEBI in the SAST Regulations, 2011 modified the offer price determiner to the volume-weighted average market price of shares for a period of sixty trading days.

- Thus, from November 2011 to June 2020, the base price considered is 60-days VWAP.