Authored by: Sunit Khandelwal & Punit Khandelwal

Download the complete report by clicking on the button.

Report Summary

What should be the relevant risk premium in India?

There is no direct or objective answer to this question, investors may have to ascertain their risk appetite depending on the purpose of the investment. Since strategic investors tend to focus on long term synergistic benefits, they would consider a long term horizon and weigh benefits against their internal hurdle rate or the desired return on investment (RoI) while evaluating any expansion plan or business acquisition. On the contrary, time-sensitive investments such that as by the private equity investors appear to be more closely linked to the recent market performance. The valuation expert may particularly focus on the context of the investment while deciding on the equity market risk.

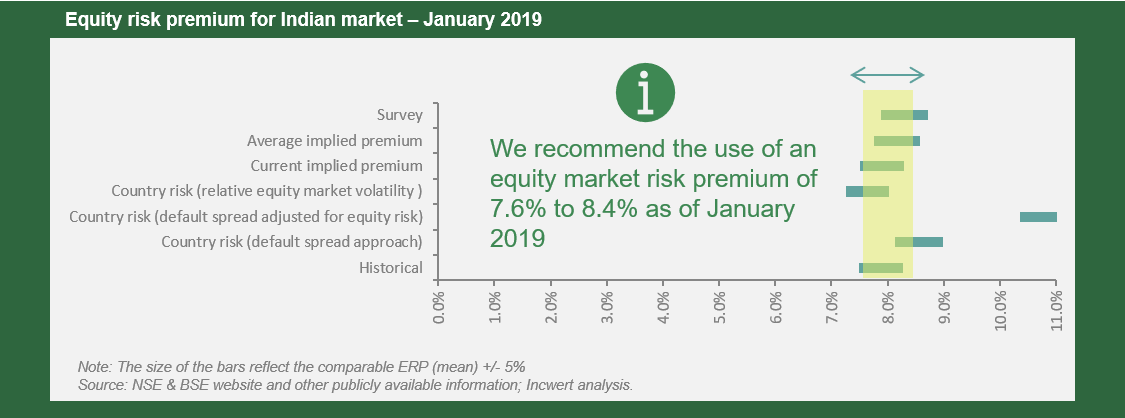

In the graph below, we present the outcome of a) Survey by Pablo Fernandez, Javier Aguirreamalloa and Pablo Linares, b) Historical premium i.e. historical returns earned in the past on Sensex stock relative to risk free rate, c) Benchmark premium based on US market equity risk premium, and d) Implied premium based on traded price of debt, equity or other credit/equity derivatives.

As valuation practitioners and business partners, we trust that you will find these of interest.

Estimation of risk premium – survey premium

Overview

Globally, several research firms survey finance and economics professors, corporate managers, financial analysts, etc. about their expectation of market returns. Whilst this data is widely available in developed markets such as the US, it is fairly a challenge to get such data in emerging markets such as India.

In this section, we present the summary of market risk premium in India based on the survey carried out by Pablo Fernandez, Javier Aguirreamalloa and Pablo Linares ('Survey of market risk premium and risk-free rate') for various countries over the various time period.

Analysis of results from the annual survey

Analysis of the table set below suggests that most finance practitioners and investors who participated in the survey assumed the risk in Indian equity to be marginally higher in 2008 compared to the following years when the fallout of US sub-prime crisis was arrested, and Indian market was largely stable.

Interestingly, the average risk premium in India from 2011 to 2017 has been in the close range of 8 - 8.5% with an average standard deviation of 2.4 - 2.9%. Furthermore, given the number of respondents to the survey, the average standard error on the mean value is approximately 0.5% which is fairly low.

Reliability of survey results?

Despite there being several of such studies or surveys being carried out by research firms and given the fact that a level-headed range for equity premium does emerge from these surveys, still the acceptance level of such an approach by finance practitioners is low. Though there is nothing incorrect with the approach that is usually adopted to carry out such survey, rather it is the individual's reasoning that could be potentially inhibited while interpreting the market dynamics. Since most respondents, in order to estimate the risk, rely on the recent market environment, their assessment may tend to be myopic with a short-term view as against a long-term view.

Estimation of risk premium – historical premium

It is tardy exercise to compute historical risk premium for emerging markets such as India where the availability of robust data is a challenge. Markets may not be sufficiently deep to allow liquidity in transactions, and frequent market frictions have the potential to skew the stock prices thereby leading to large volatility in stock prices and imperfect market information e.g. mid and small-cap stock in India witness prolonged period of low activity in trading volume, implying that they may not react instantaneously to the changes in macro-economic factors that otherwise govern the systematic risk.

Arithmetic mean:

Based on our analysis, we observe that the equity market in India has delivered an average return of 19.9% over the period 1991 to 2018, which is significantly higher when compared to the average return on treasury bond (10.37%) or bill (8.58%) over the same period. This, however, comes with the additional burden of higher volatility of 33.7% and quite an extreme range in distribution of stock returns.

The equity risk premium, calculated as a difference between the average returns on stock and the average returns on treasury bill for the period 1991 to 2018 is 11.32%, and similarly, the difference between the average returns on stock and average returns on treasury bond over the period 1991 to 2018 is 9.53%.

These estimates are however not free from noises. Given the limited coverage period of 28 years, the standard error contained in these estimates is fairly high. Risk premium over treasury bill and treasury bond forebear high standard error of 6.4% and 6.5% respectively.

Geometric mean:

Now consider a simple change in the basis of averaging from the arithmetic mean to the geometric mean. The observed equity risk premium undergoes considerable change. For the period 1991 to 2018, the equity premium is now 4.94% and 2.90% over the treasury bill and treasury bond respectively. Given that returns on stock are negatively correlated over time (based on empirical studies), a statistical or valuation expert will have natural biases towards the geometric average premium. Nevertheless, there are investors who argue for the arithmetic average premium as the best estimate of risk premium.

Further, let us examine the impact on risk premium when we change the time duration. For shorter time durations, the results change remarkably. Risk premium (geometric mean) over the last 15-year period is 7.55% and 7.95% over treasury bills and treasury bonds respectively. This phenomenon can be partly explained by the low index base in 2003 when the investor confidence was low following the ‘Ketan Parekh’ scam of 2001 that had left several investors in the lurch and compelled the index to bottom out by 2003. Subsequent to this, renewed global interest in India as an investment destination led to substantial capital inflows from FIIs and FDIs and pushed the index to all-time high just before the US sub-prime financial crisis. These factors together explain the reason for risk premium movement during the last fifteen years.

Country risk premium – credit default spread approach

The equity risk premium for India is derived by adding CDS of 170 basis points to the base ERP of 5.1% of the US market. The resultant equity risk premium for India is 6.8% in US dollar terms. After adjusting for forward-period inflation factor, the ERP for India is determined to be 8.6% in INR terms.

Potential shortcomings of this approach

Despite being conventional and easy to apply, this approach has its own shortcomings:

–First, rating agencies often lag markets when it comes to responding to the changes in the underlying default risk. e.g. Greece’s rating was not downgraded until the middle of 2011, though their financial problems were visible well before that time.

–Second, the timing of rating is sporadic, and such intermittently issued rating fails to mirror the equity market movements on a continuous basis.

–Third, the rating agencies focus on default risk may obscure other risks that could still affect the equity markets.

Conclusion

This approach finds favour with analysts who prefer using the typical default spread citing the argument that these spreads tend to be less volatile and more reliable for long-term analysis. Further, the assigned rating is a forward-looking estimate of default probability and therefore should not only be reflective of current performance but also an estimate of future ability and willingness of the sovereign to service the debt.

Country risk premium – credit default spread adjusted for equity risk

Continuing from the previous section, we see that if the Indian government were to issue dollar-denominated sovereign bonds then it is likely to trade with a default spread of approximately 170 basis points over the US treasury bond rate considering the Baa2 rating that India has vis-a-vis Aaa of the US.

The annualised standard deviation in the Indian equity index (NSE Nifty) during the 24 months period ending 31 December 2018 was 11.23%, while the annualised standard deviation in the 10-year government bond was 4.86%. Accordingly, the resultant additional country equity risk premium for India is 3.9%

The equity risk premium for India is derived by adding a country risk premium of 3.9% to the base ERP of 5.1% of the US market. The resultant equity risk premium for India is 9.0% in US dollar terms. After adjusting for forward inflation factor, the ERP for India is determined to be 10.8% in INR terms.

Potential measurement problems

The standard deviation of equity returns is a volatile number across time and given that India is still an emerging market, the volatility could move significantly across different time periods. To avoid any such abnormality the calculation considers the recent market performance.

Illiquidity in emerging markets may lead to lower volatility and consequently lower estimation of country equity risk.

This approach presupposes a linear relationship between equity market volatility and bond price volatility whereas, in reality, the situation is quite different.

Country risk premium - Relative equity market volatility in the US and India

The annualised standard deviation of weekly returns in S&P 500 in two, five and ten years preceding 31 December 2018 have been computed in the table below. Correspondingly the annual standard deviation of weekly returns NSE Nifty for the same period has also been computed. The relative standard deviation has been computed for each such period. Note that daily standard deviations tend to have much more noise and hence computations have been done on weekly returns.

Using the relative standard deviation so derived and the US base equity risk premium of 5.1%, the estimated equity risk for India based on two, five and ten-year volatility is 4.3%, 5.5% and 5.8% respectively. After adjusting for forward inflation factor, the ERP for India is determined to be 6.1% to 7.6% in INR terms.

While the volatility in the US equity market is nearly the same for two year and five year period preceding 31 December 2018, the volatility in Indian equity market has varied significantly between the two year period (annualised standard deviation of 12%) and ten year period (annualised standard deviation of 18%) possibly due to structural illiquidity in Indian markets post the global financial crisis of 2009 and Euro zone credit crisis of 2011.

The Indian market witnessed significantly reduced volatility during the last two years. The trend is, however, likely to undergo a change with general elections due in 2019, rising oil prices, global trade wars, and increasing interest rates in the US amongst other factors. As such, equity risk premium based on ten-year period volatility (compared to a shorter duration) could be a fair representative of equity risk premium in India.

Implied premium - Gordon’s Dividend growth model

This method assumes that dividend will grow constantly at a stable rate in the future. Real life scenario will, however, be quite different as we can expect the Indian markets to continue to evolve with growth and interest rates tapering gradually to that of a developed market such as the US.

Dividend paid out is assumed to be equivalent to the free cash flows that are available with the company. Stock buy-backs have not been considered within the calculation of dividend yield. We have used BSE Sensex data to derive the implied equity risk premium. As at 31 December 2018, the BSE Sensex Index closed at 36068, and the average dividend yield on the index was approximately 1.16%.

The sustainable growth in dividend for companies in the index, based on the average annual compounded growth in dividend between 1991 and 2018, is assumed to be 14%. Given the yield on 10-year G-sec bond was 7.4% as at 31 December 2018, the equity risk premium is derived to be 8.0%.

Read more?

Download the complete report by clicking on the button.