Authored by: CA Punit Khandelwal, CA Sunit Khandelwal and Prof. Divya Aggarwal (IIM, Ranchi)

Assisted by: CA Akshat Jain

Foreword

We are pleased to issue the fourth edition of the India Equity Risk Premium (2022) study, which analyses the risk premium to be considered when determining the cost of equity using the capital asset pricing model.

The study focuses on quantitative analysis to derive the current equity risk premium under different approaches including a) historical premium, b) survey approach, c) country bond default spread approach, d) country bond default spread approach adjusted for relative country risk, e) domestic market volatility relative to a developed market, f) and implied equity risk premium.

This issue includes coverage of historical ERP using both Sensex and NIFTY50 indices. A detailed cross-section of the value of ERP is presented in this report, allowing a user to choose the time frame as considered appropriate.

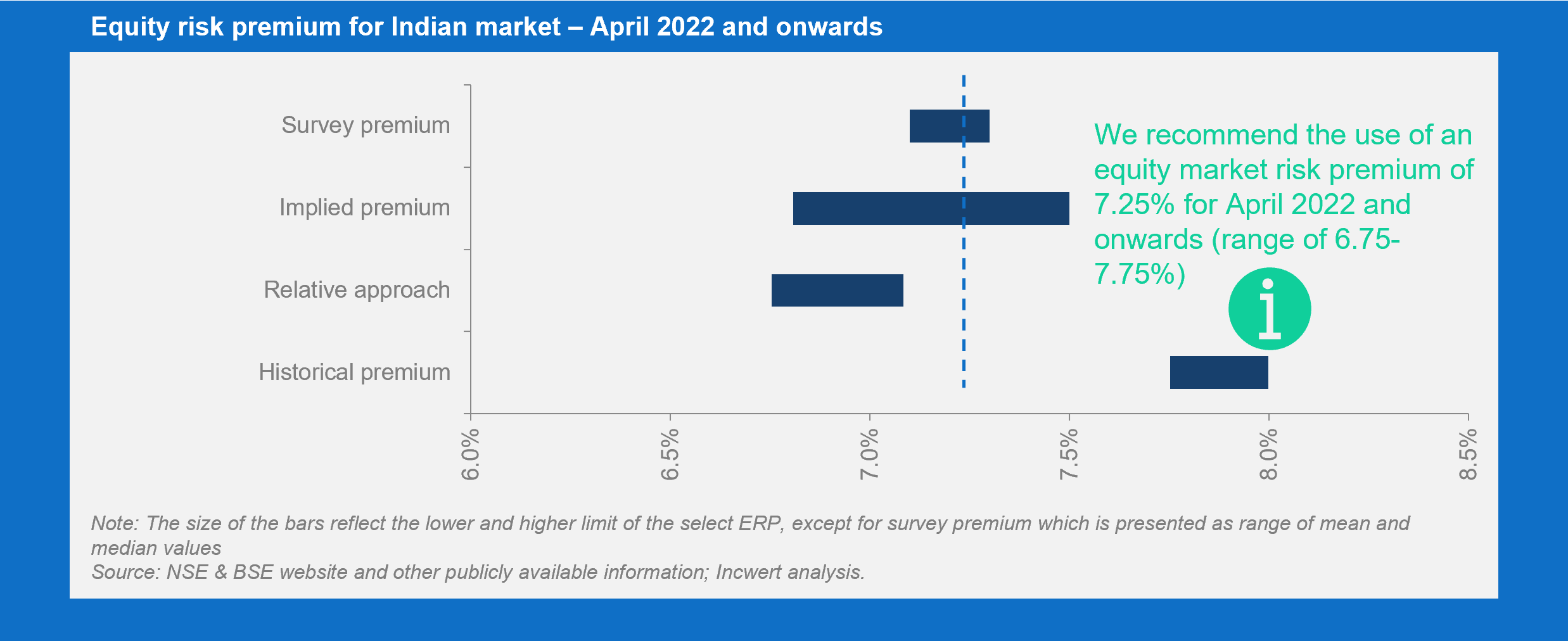

The inflation surge, policy tightening, and the fallout of the Russia-Ukraine conflict have been hurting the markets. We expect the economy’s outlook in the near term to remain fragile with volatile investor returns. Accordingly, based on the current market conditions, we recommend India ERP of 7.25% ( 6.75% and 7.75% being the lower and upper limit of the range, respectively) beginning April 2022.

We hope you find the results of our study of interest and value.